This is an organization that checks a number of past public records in order to identify any errors or other potential misrepresentations on life insurance applications. Ad Extensive Motor Insurance Policy.

What Is Mib Group And How Does It Affect Life Insurance Applications Forbes Advisor

What Is Mib Group And How Does It Affect Life Insurance Applications Forbes Advisor

MIB data and analytics empower our members to see risk clearly and take action decisively.

Mib life insurance. This then can help with maintaining a more equitable marketplace for insurance carriers. Check out results for your search. - Assistance Finding Lost Life Insurance.

The primary goal of the Medical Information Bureau is to help in ensuring that insurance companies can offer and that consumers can obtain more affordable life and health insurance coverage. Is a member-owned corporation that has operated on a not-for-profit basis in the United States and Canada since 1902. This helps life insurance companies avoid fraudulent customers and claims.

MIBs Underwriting Services are used exclusively by MIBs member life and health insurance. Drawing from North Americas largest database of life and health insurance applicants our member companies identify anti-selection detect fraud and pinpoint errors. Policies in lower face amounts 100000 and below Guaranteed issue and employer-based life insurance that is not individually underwritten.

They do this by compiling information from previous life health disability or long-term care insurance applications. Operating in the US. The MIB was founded in 1902 to work with life insurance companies to combat fraud.

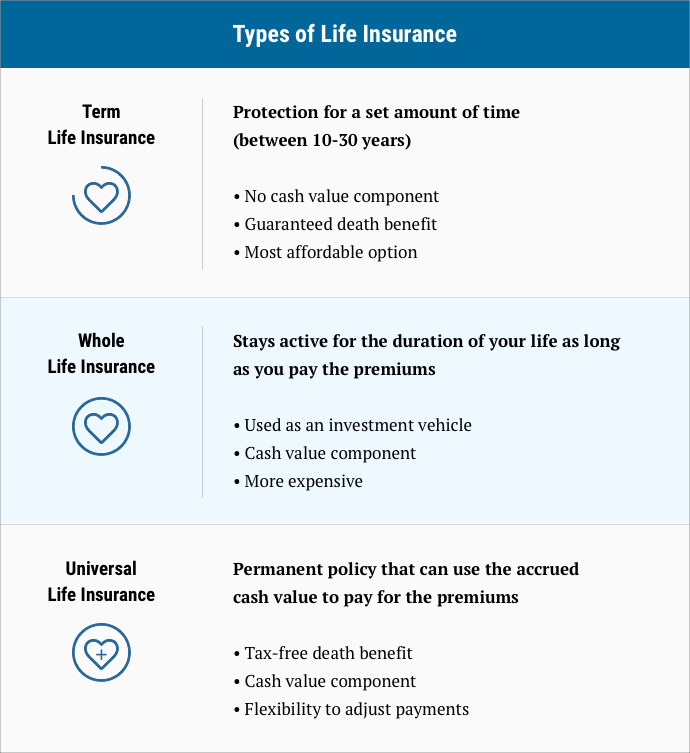

Products available in the market are designed to address various preferences. Contrary to what you think or what has been told to you the MIB does not have your medical records. For more than 125 years MIB has been a leading force for accurate risk assessment.

MIB ensures that companies can offer and consumers can purchase affordable life and health insurance protection. You may arrange a life assurance policy for protection savings or a combination of both. In life insurance the beneficiary is the person or entity entitled to receive the policy proceeds upon the death of insured.

What is the Medical Information Bureau. And Canada since 1902 the MIB Group is a member-owned corporation that provides underwriting services to life and health insurance companies. The MIB Life Index is the life insurance industrys timeliest measure of application activity across the US.

Since the vast majority of individually underwritten life premium. MIB the life insurance industrys most trusted and secure partner for data-driven risk management and digital services and Cerner Corporation a global healthcare technology company announced an. In our experiences here at IE what weve found to usually be the case is that if someone is inquiring about what the Medical Information Bureau MIB is its probably because youve already applied for a life insurance policy and you have been told that there is something in your MIB report that is affecting the outcome of your life insurance application.

Because some beneficiaries are not aware of their entitlement to the death. Get Free Quotation Buy Online Now. MIB stands for the Medical Information Bureau.

1 The following types of life insurance generally will not be covered. Check out results for your search. Ad Find info on MySearchExperts.

Through previous applications for individual insurance life insurance health disability insurance critical illness and long-term care insurance member insurers submit your information in encrypted format to the MIB. Ad Extensive Motor Insurance Policy. Released to the media in the second week of each month the Index is based on the number of searches member company underwriters perform on the MIB Checking Service database.

So if youve never previously applied for these types of insurance there wont be any records for you in the MIB. BRAINTREE Mass April 21 2021 PRNewswire -- MIB the life insurance industrys most trusted and secure partner for data-driven risk management and. Life insurance policyholders may fail to inform the beneficiary ies of a policys existence.

Get Free Quotation Buy Online Now. MIBs services help insurers. Ad Find info on MySearchExperts.

Life assurance provides for the payment of a sum of money in the event of the death of the Life Assured. Covers only underwritten life insurance applications taken at MIB member companies from January 1 1996 to the present.