See Tax relief for quarterly and annual sales tax vendors affected by COVID-19 to request relief from penalty and interest. The Governor of New York has issued an executive order expanding the abatement of late filing and payment penalties to allow abatement of interest on quarterly sales and use tax filings and remittance for March 20 2020 due dates.

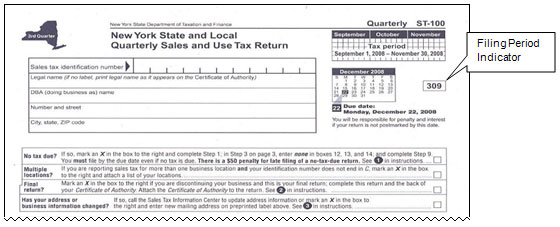

Filing Period Indicators On Final Sales Tax Returns

Filing Period Indicators On Final Sales Tax Returns

Metropolitan commuter transportation mobility tax MCTMT 2021 2020 For information about other tax filing due dates see.

Nys quarterly sales tax due dates 2020. The sales tax relief for quarterly and annual sales tax vendors affected by COVID-19 has been extended to June 22 2020. Sales tax returns may be filed annually. Sales tax return due for monthly filers.

Please visit wwwtaxgovcalendar for additional information. Find out more about Californias response to COVID-19 here. Sales tax payments and returns were due March 20 2020.

Monday June 22 2020. Filing frequency is determined by the amount of sales tax collected monthly. Monthly sales tax due on June 1 2020 Quarterly payment sales tax due on May 26 2020 Due to COVID-19 California sales taxpayers affected by COVID-19 can request to file and pay any sales tax due between March 15 2020 and June 15 2020 by June 15 2020.

New York State Sales Tax Returns for Quarterly Filers for September 1 2021 November 30 2020 are due by December 20 2021. Q3 Sep - Nov December 20. See N-20-6 Extension for the Abatement of Penalties and Interest for Sales and Use Tax due to the Novel Coronavirus COVID-19.

Q2 Jun - Aug September 20. However penalty and interest may be waived for quarterly and annual filers who were unable to file or pay on time due to COVID-19. Annual returns are due January 20.

66 rows Partnership and LLC estimated tax payments NYS and MCTMT if applicable required to be. Tax filing calendar. Since sales tax returns are generally due within 20 days after the end of the reporting period annual returns are.

The New York State NYS Department of Taxation and Finance extended the payment deadline for quarterly and annual sales and use tax once again setting a new due date of June 22nd. March 2020 Sales Tax Due Dates March is a fairly smooth sales tax filing month for most sellers after the mania of January. 49 rows 1st quarter.

Below weve grouped New York sales tax filing due dates by filing frequency for your convenience. Q4 Dec - Feb March 20. Under 300 per month.

15 or less per month. Filing Frequency Due Dates. Sales tax returns may be filed quarterly.

Alcoholic beverages tax Individuals. Due Date Extended Due Date. Q1 Mar - May June 20.

These calendars include the due dates for. 66 rows Sales tax return due for quarterly filers. The annual return Form ST-101 New York State and Local Annual Sales and Use Tax Return covers the period March 1 through February 2829.

Andrew Cuomo announced in a press conference that while New York state didnt officially change its March 20th due date to pay sales taxes the. March 1 2020 - May 31 2020 Due date. New York State Sales Tax Returns for Quarterly Filers for September 1 2021 November 30 2020 are due by December 20 2021.

The New York Department of Taxation and Finance requires all sales tax filing to be completed by the 20th of the month following the assigned filing period. Due dates falling on a weekend or holiday are adjusted to the following business day. If you are a monthly filer youll have a deadline but quarterly and annual filers are off the hook except for New York tax filers.

New York State Department of Taxation and Finance N-20-1 Returns must be filed within 60 days of the due date.