When a worker files for retirement benefits the workers spouse may be eligible for a benefit based on the workers earnings. According to Social Securitys website though you can apply for spousal benefits online.

Social Security Spousal Benefits The Complete Guide

Social Security Spousal Benefits The Complete Guide

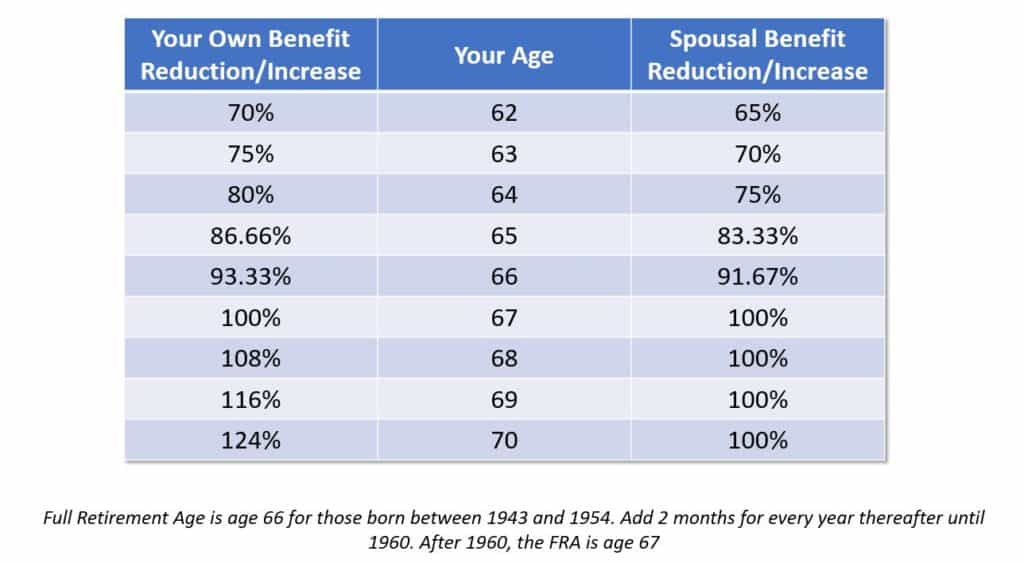

You can receive up to 50 of your spouses Social Security benefit.

How to apply for spousal benefits. On the Social Security Administration website by phone at 1-800-772-1213 or by visiting your local Social Security field office. A widower or survivor of a deceased ex-spouse may file a restricted application even if they have not yet reached full retirement ageregardless of when they were born. You have been married for at least a year.

The benefit is similar in fact to the spousal benefit that is available to a person who is still married. You are at least 62 unless you are caring for a child who is under 16 or disabled in which case the age rule does not apply. Applying for Spousal Disability Benefits.

As of January 2017 the average spousal benefit is about. You can collect benefits on a spouses work record regardless of whether you also worked. Eligibility requirements and benefit information.

If your husband or wifes disability claim has already been approved call the Social Security Administration SSA at 800 772-1213 to apply for the spouses SSDI benefit. You can make an appointment to file an application by calling 1-800-772-1213 or you can contact your nearest office. You can apply for benefits if you have been married for at least one year.

If your ex-spouse has not applied for retirement benefits you can receive benefits on his or her record if you have been divorced for at least two years and your ex-spouse is at least 62. Basically there are two sets of rules that determine whether you qualify. How do I apply for spousal benefits.

Once approved you will receive monthly payments by check or direct deposit. A spouse must be full retirement age and have been born on or before January 1 1954 to file a restricted application for a spousal benefit onlyand must not have already begun their own benefits. The first applies if your ex-spouse is living and the second applies if hes deceased.

Applying for Spousal Benefits If Youre Already At Full Retirement Age If youre already at full retirement age at least 65 or older youll receive your own regular Social Security payments first. You can file for spousal benefits the same way you would earned benefits. Spousal benefits are an important feature of Social Security and are currently collected by nearly 24 million spouses of retired workers.

Benefits for Spouses. In addition spouses cannot claim the. For spouses to receive the benefit they must be at least age 62 or care for a child under age 16 or one receiving Social Security disability benefits.

If you have been divorced for. But this does not apply if your are filing for a spousal benefit from an ex-spouse. If you are divorced If you are divorced and your marriage lasted at least 10 years you may be.

Applications can be filed up to 4 months in advance of the month you want to switch to your own record. If you are at least 62 years of age and you wish to apply for retirement or spouses benefits you can use our online retirement application to apply for one or both benefits. Another requirement is that the spouse must be at least age 62 or have a qualifying child in herhis care.

Your spouse is already collecting retirement benefits. Social Securitys online applications can only be accessed by people who actually intend to file for benefits and I have no personal experience with the online filing process. The SSA uses your highest work earnings over 35 years to calculate this monthly payment amount.