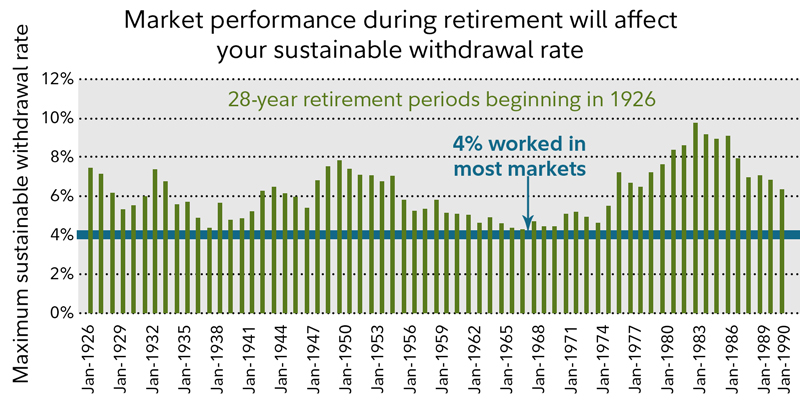

The Trinity Study would indicate a 45 withdrawal rate. This rule dictates withdrawing 4 percent of your portfolio in the first year of.

More Charts Withdrawal Rates And Portfolio Longevity My Money Blog

More Charts Withdrawal Rates And Portfolio Longevity My Money Blog

When planning your retirement fund dispersals the short answer is 4 but there are a number of very important caveats.

Retirement withdrawal rate. The worst-case for a 425 withdrawal rate was 28 years. Theres a decent chance that anyone who has considered retirement with some amount of self funding has heard of the concept of the safe withdrawal rate -- the amount of money that one can safely spend every year without prematurely running out of money. Traditional calculations say this withdrawal rate is about right.

The safe withdrawal rate helps you determine a minimum amount to withdraw in retirement to cover your basic need expenses such as rent electricity and food. But what if you were more comfortable with a success rate closer to 85 for 30 years. It will be around 3-33.

A 4 withdrawal rate over a 30year retirement horizon with a 5050 mix of stocks and bonds was 100 successful. Examples include an annual withdrawal rate of 5 or the IRS required minimum distribution RMD which increases the withdrawal rate depending on your age. Traditionally retirees have been encouraged to follow the 4 percent rule when taking retirement distributions.

Because of this some have advocated that a safe retirement withdrawal rate should be as low as 24. First proposed by William Bengen in 1994 the math is pretty. 4 or 45 Percent Ever since financial planner Bill Bengen came up with the 4 percent rule aka the Bengen rule in 1994 many financial advisers have been recommending 4 percent.

Even decades into your retirement the imprint of your retirement year comes through in your annual safe withdrawal rate. An initial withdrawal rate of 4 was considered safe because it never resulted in a portfolio being exhausted in less than 33 years. Your retirement savings have to last for the rest of your life -- how much you withdraw each year is important.

The 4 rule assumes a rigid withdrawal rate throughout retirement. It is not like instead of a 30-year retirement you have a 60-year retirement you would need to move your initial withdrawal rate from 4 to 2. An allocation in the 50-75 range was the sweet spot.

You decide to increase your annual withdrawal by 35 and want the money to last for 35 years with nothing left for heirs after that time. For example the IRS RMD withdrawal. 5 Is the New 4 -- for Making Your Money Last.

Having too much in stocks during retirement is just as risky as having too little in stocks. Retirement planning doesnt have to be complicated. Also this is the SWR that is widely adopted around the FIRE community.

You can spend about 4 of your investments each year and most likely never run out of money. Your withdrawal rate for the year is 4 percent 16000 divided by 400000 and then multiplied by 100. With the safe withdrawal rate you can determine how risky your portfolio and your retirement strategy is.

If you only plan to live 15 to 20 years after retiring you can withdraw 5 to 6 each year rather than 35 to 4. The Trinity Study concludes that a 4 SWR adjusted for inflation is recommended for a 30-year retirement. Retirees take out 4 in the first year of retirement.

After that they adjust their annual withdrawals by the rate of inflation. It is also referred to as the 4 Rule or the Rule of 25. 25Years until you retire age 40 to age 65 35Years of retirement.

Following the Six Withdrawal Rate Rules If you want to withdraw a little more money than in the example above there are a set of six rules you can follow that will give you the greatest probability of increasing your retirement income. Using Shiller CAPE or Earnings yield and use market valuation to time the initial withdrawal rate to use. Reputable sources argue this is too aggressive during periods of low interest rates andor high market valuations thus advocating a.

Conventional wisdom in retirement planning claims a conservative withdrawal rate should be 4 annually adjusted for inflation. You may hope for a juicy 8 withdrawal allowance but if your retirement year puts you firmly in the 4 category you cannot shake that off no matter how long your period is. You think you can earn 5 per year in retirement and assume inflation will average 35 per year.

Also remember that a shorter retirement means a higher safe withdrawal rate. What Is a Safe Withdrawal Rate in Retirement.