Clark frequently highlights that feature as a benefit of Fidelity which does the same thing but currently pays only 001 APY. Robinhood notes the interest will add up to.

Robinhood Revives Checking With New Debit Card 1 8 Interest Techcrunch

Robinhood Revives Checking With New Debit Card 1 8 Interest Techcrunch

With Robinhood Cash Management you earn interest on any uninvested cash in your brokerage account.

Robinhood high yield savings. Investing for the long-term often means that a person can seek greater risks and rewards. This is the second attempt for the company after a botched rollout of a. In December 2019 Robinhood started offering a cash management account that currently pays 030.

Customers will earn 3 percent annually on both the checking and savings accounts with interest paid out daily. The Robinhood Cash Management Account is its hybrid savings and checking account. After reading all the interest about Robinhoods 3 Checking Account I did some research and found the BEST Savings accounts that offer the highest interest.

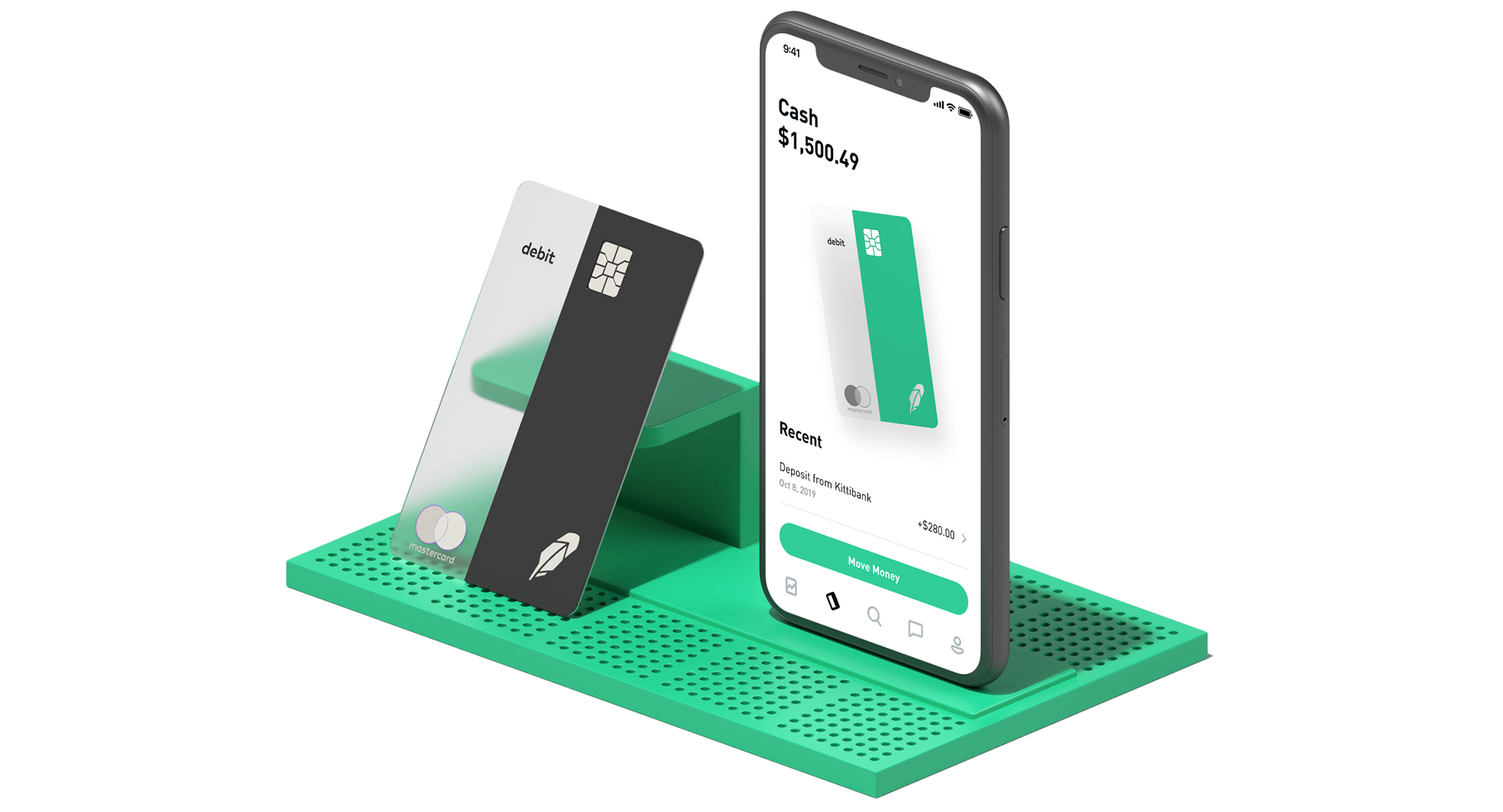

Robinhood essentially treats clients uninvested cash as a high-yield savings account with an APY that rivals even the best online savings. Cash management account holders will also get the benefit of having unrestricted access to funds with a Robinhood ATM debit card which can be used for purchases anywhere that Mastercard is accepted. And then it could make sense for anyone due the decent rate.

The account comes with a debit card and free ATM withdrawals from more than 75000 ATMs and offers up to 125 million of FDIC insurance thanks to Robinhoods agreements with several banks. 3 High-Yield Dividend Stocks Robinhood Investors Love With yields ranging from 66 to 86 income investors can get rich from these payouts. It pays a relatively high interest rate like a high-yield savings account but it comes with a.

Robinhood and ETRADE both offer commission-free trading on multiple investments but each brokerages account types features and fees vary. The annual yield is currently 30 which slightly less than the average high-yield savings account earning 50. When comparing them against the likes of Ally and Discover who maintain good rates over the long haul Robinhood.

Best high-yield savings accounts. Fintech investing platform Robinhood on Thursday introduced its own no-fee checking and savings products that earns 3 percent. Like high yield savings accounts the net yield fluctuates alongside interest rates.

You open a high-yield savings account with a 100 APY whereas your friend opens a typical savings account with a 005 APY. They arent at the top of the list of rates but its hard for certain which of those banks at the top will keep the high rates long term. You want a savings and brokerage account in one.

Depending on your time horizon and risk tolerance this money may belong in a high-yield savings account a money market account or certificates of deposit. It still could make sense for someone who uses Robinhood for trading I wish my brokerage had a high yield savings account. That is three-quarters of.

Financial app Robinhood introduced its new cash management account this week offering an initial 18 APY on savings. However as of this writing the APY is set at 030 which is less than you would get from the best high-yield savings accounts. Robinhoods cash management account currently pays 030 APY and automatically sweeps uninvested cash into savings.

SIPC ahead of the launch. A vastly improved search engine helps you find the latest on companies business leaders and news more easily. In December Robinhood said it would offer zero-fee checking and savings accounts with a 3 interest rate alongside its brokerage accounts.

Stock trading app Robinhood is offering a high-yield cash management account after it failed to launch the product in mid-December. The companys first savings account endeavor was halted after it neglected to notify the Securities and Exchange Commission SEC or the Securities Investor Protection Corp.

.1565009580411.png)