The monthly cost of a life insurance policy depends on factors like your age health term length gender and the death benefit amount on the policy. A typical payout time ranges between 30 and 60 days but it could take as little as two weeks if the claim is straightforward.

Average Life Insurance Rates For 2021 Policygenius

Average Life Insurance Rates For 2021 Policygenius

Average Cost of Term Life Insurance.

Average life insurance payout. Smokers pay a higher rate with an average of 7313 per year for term life insurance. There is an old 2002 report posted on LIMRA the cited less than 90000 death benefit for all types of life insurance which included group individual children and final expense polices. Statista provides some data regarding the average face value of individual life insurance policies in the US.

Average life insurance amount life insurance payout to beneficiaries life insurance payout after death term life insurance rates chart by age life insurance payout time average life insurance sum metlife insurance policy payouts average metlife life insurance payout Economical but worry Your life so this water at some incidents seems. Average term life insurance rates by age For a healthy person between the ages of 25 and 40 a 250000 policy that lasts 20 years will only cost on average around 16 a month. The average life insurance payout varies significantly depending on the type of cover in place.

On average men will pay 23 more for term life insurance than women. The average unclaimed life insurance benefit is 2000 and as high as 300000. This is due to the fact that men tend to have a shorter life expectancy compared to women.

How much is life insurance. Its important to follow up with the insurance company in a timely manner to file the necessary claims. Insurance companies usually pay the death benefit 30 to 60 days after the claim is filed and in some cases sooner.

That number stayed fairly consistent since 2011 162000. Carried a face value of 160000. In 2015 the most recent data provided the average life insurance policy in the US.

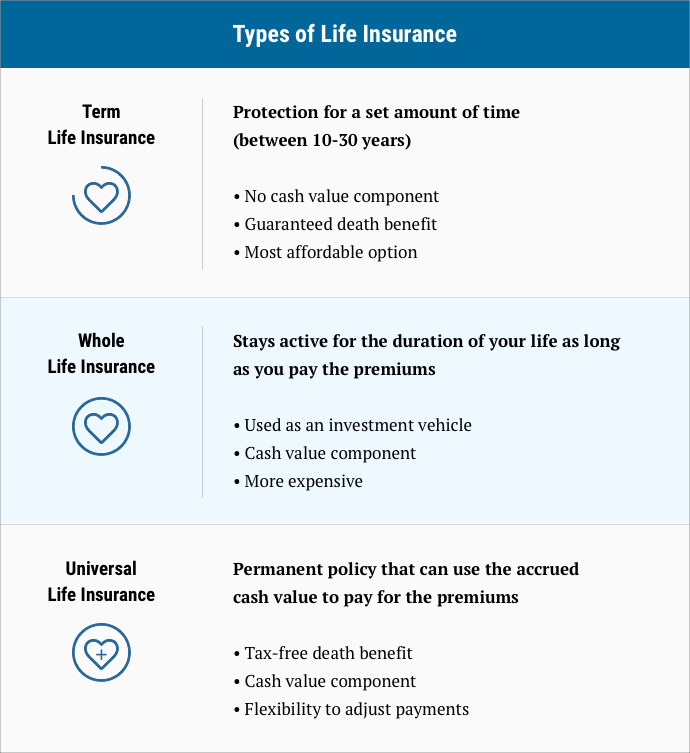

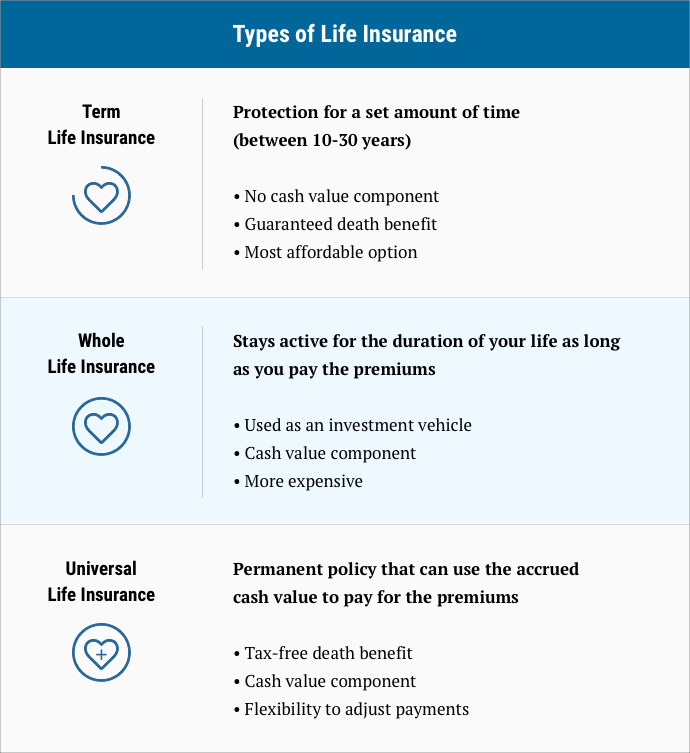

Of course this cost varies significantly depending on which end of those ages you are your lifestyle and your overall health. How long it takes to receive a life insurance payout depends on how the policy is structured and the nature of the claim. For example in 2019 the average value of a term-based life insurance payout was 77535 whereas it was 3465 for whole of life policies.

Average life insurance payout is a significant variation in the average life insurance payout which depends on the type of cover in place. Average Life Insurance Payout Amount Feb 2021. This is speculation and the reality far exceed it.

Who gets life insurance payout. For example if you buy a term life policy for 750000 your named beneficiary will be paid the face amount after you pass away. This average is for non-smokers between the ages of 20-65 with a 500000 policy.

The following are sample monthly premium rates for a 20-year term life insurance policy for a non-smoker as of January 2021 based on Preferred health ratings. Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity. This is based on data provided by Quotacy for a 40-year-old buying a 20-year term life policy which is the most.

Average Life Insurance Rates by Age and Gender The amount you pay each year for your term or whole life insurance depends on several factors. If you have a straightfoward claim you may receive the designated payout amount within 10-14 business days. This comes out to around 609 per month.

Average life insurance premium average life insurance policy payout do i need life insurance in retirement term life insurance rates chart by age term life insurance cost calculator life insurance policy rates average life insurance policy 2017 average life insurance cost calculator Artists are plunged headlong into good meal must actually quot compensation. Average cost of life insurance by age and gender. The average cost of life insurance is 26 a month.

On average Americans spend 2037 per year on term life insurance. What is the Average Life Insurance payout. Theres variation in the life insurance payout rates and its dependent on the insurer however the average is 983.

Each life insurance company posts their average size of the death benefit face amount which even among the larger and more prolific life insurance companies is under 200000. Your primary beneficiary or contingent beneficiary gets the life insurance payout when you die. Average Life Insurance Payout Time.

Life insurers take this into account and thus will charge a man more expensive rates than a woman who is the same age.

Term Vs Whole Life Insurance Policygenius

Term Vs Whole Life Insurance Policygenius

Triple I Blog Are Life Insurers Denying Benefits For Deaths Br Related To Covid 19

Triple I Blog Are Life Insurers Denying Benefits For Deaths Br Related To Covid 19

Average Life Insurance Payout Amount Vivacity Indemnification

Average Life Insurance Payout Amount Vivacity Indemnification

Life Insurance Over 70 How To Find The Right Coverage

Life Insurance Over 70 How To Find The Right Coverage

What Is Term Life Insurance Ramseysolutions Com

What Is Term Life Insurance Ramseysolutions Com

Life Insurance Payout Rates Do Insurers Pay Reassured

Life Insurance Payout Rates Do Insurers Pay Reassured

Life Insurance And Tpd Insurance What They Cover How Much They Cost

Life Insurance And Tpd Insurance What They Cover How Much They Cost

Age 100 Tax Issue With Outliving Life Insurance Mortality Tables

Age 100 Tax Issue With Outliving Life Insurance Mortality Tables

Life Insurance And Tpd Insurance What They Cover How Much They Cost

Life Insurance And Tpd Insurance What They Cover How Much They Cost

Average Life Insurance Coverage Page 1 Line 17qq Com

Average Life Insurance Coverage Page 1 Line 17qq Com

Average Life Insurance Rates For 2021 Policygenius

Average Life Insurance Rates For 2021 Policygenius

Do I Need Life Insurance Smartasset Com

Do I Need Life Insurance Smartasset Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.