How do I start saving for retirement. MoneySuperMarket data showing the ages of those making savings accounts enquiries during July 2018.

/HiRes-57c48a5a5f9b5855e5d21768.jpg) How To Choose The Best Retirement Investments For Your Portfolio

How To Choose The Best Retirement Investments For Your Portfolio

Fidelity is consistently a top-rated brokerage and takes the top spot on our list of the best retirement accounts.

/average-retirement-savings-by-age-4155888_color2-dc8beecd73664342a6c7800d59b20c6e.gif)

Best retirement savings account. Unlike traditional and Roth 401ks these retirement accounts are. Fidelity offers no-fee accounts a large list of high-quality mutual funds at no cost access to virtually every stock and bond out there and industry-leading access to research so you know you are making the best investments. The average savings account earns just 006 annual percentage yield APY while retirement accounts will give you much better yields from 015 up to 1.

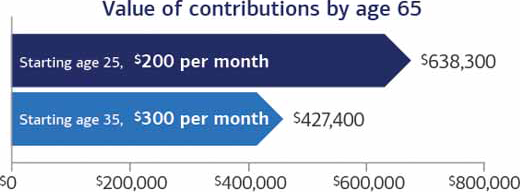

When you decide to start saving the two main options are contributing to a pension or opening an ISA. When it comes to retirement planning Americans are often way behind. Low-costs All of the companies featured in this list have very low fees with some not charging you anything to enroll.

CIT Bank offers two different high-yield savings accounts. One of the most powerful retirement savings accounts is the solo 401kThe solo 401k is ideal for self-employed workers who earn a. A retirement savings account is a good way to start saving for retirement given that you stand to earn higher returns when compared to conventional bank accounts.

155 - 185 Minimum Account Balance. Retirement savings accounts typically award a higher interest rate than regular savings accounts as their purpose is to help you save for retirement. Compare your retirement options to find the best account for your situation or explore other retirement plans to start saving for the future.

You may also be. A pensioner high interest savings account is a savings account that is set up after you have hit a certain age in order to help manage your retirement money more easily. Not only does it give you an upfront tax break and tax-protected growth like a 401k it also provides for tax-free withdrawals if the money is used for health care.

This will allow you to review your entire financial picture and include your personalized Social Security. As you weigh different retirement savings options traditional IRAs or individual retirement accounts may come to mind. You invest your retirement.

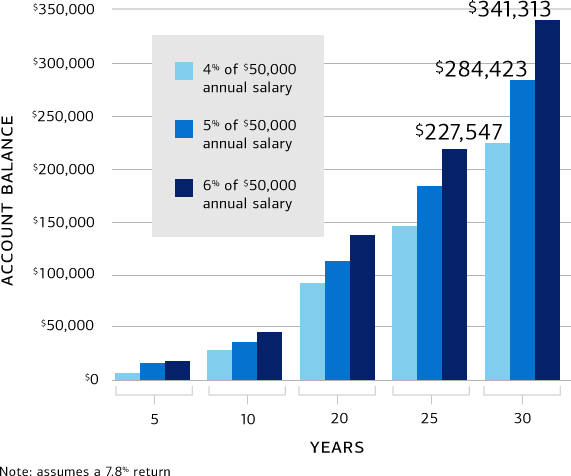

Lets dive into some of the most common employer-sponsored retirement accounts out there so you can figure out which plan works best for you. The best way to determine if you are saving enough for retirement is to run a more detailed retirement savings estimate using a retirement calculator and then create a budget plan for retirement based on realistic lifestyle expense needs. In fact in 2019 almost half of households headed by someone 55 or older had no retirement savings.

The accounts function in slightly different ways but they are both FDIC insured are free to open and maintain and offer mobile check deposit and transfers with the CIT Bank mobile app. A retirement account is the best place for your savings because it offers tax breaks and you could potentially earn a lot more than you would with a savings account. A health savings account HSA can also function as a stealth IRA and is an excellent account to use for retirement savings.

401k A 401k is a retirement fund that companies offer you to help you save for retirement and its the most common type of retirement. The Premier High Yield Savings and Savings Builder.

10 Ways To Help You Boost Your Retirement Savings Whatever Your Age

10 Ways To Help You Boost Your Retirement Savings Whatever Your Age

The Best Order Of Operations For Retirement Savings Account Maximizing

The Best Order Of Operations For Retirement Savings Account Maximizing

10 Ways To Help You Boost Your Retirement Savings Whatever Your Age

10 Ways To Help You Boost Your Retirement Savings Whatever Your Age

Best Retirement Plans Choose The Right Account For You Nerdwallet

Best Retirement Plans Choose The Right Account For You Nerdwallet

/how-much-should-i-put-in-my-401k-410a513b95894b9db05bb2897cec881e.png) How Much Should I Put Aside For Retirement

How Much Should I Put Aside For Retirement

Types Of Iras Explained Which One Is Best For You Ira Accounts Retirement Savings Plan Saving For Retirement

Types Of Iras Explained Which One Is Best For You Ira Accounts Retirement Savings Plan Saving For Retirement

Types Of Retirement Accounts Which One Is Best For You Ramseysolutions Com

Types Of Retirement Accounts Which One Is Best For You Ramseysolutions Com

Best Retirement Plans Choose The Right Account For You Nerdwallet

Best Retirement Plans Choose The Right Account For You Nerdwallet

Best Retirement Plans Choose The Right Account For You Nerdwallet

Best Retirement Plans Choose The Right Account For You Nerdwallet

/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png) The Best Retirement Plans To Build Your Nest Egg

The Best Retirement Plans To Build Your Nest Egg

/saving-for-retirement-with-a-late-start-38e3bb030ef242649b53f1ad16826b10.png) 7 Tips For Saving For Retirement If You Started Late

7 Tips For Saving For Retirement If You Started Late

/average-retirement-savings-by-age-4155888_color2-dc8beecd73664342a6c7800d59b20c6e.gif) Average Retirement And Emergency Savings By Age

Average Retirement And Emergency Savings By Age

The Best Retirement Account Is Not What You Think Health Savings Account Investing Money Retirement Savings Plan

The Best Retirement Account Is Not What You Think Health Savings Account Investing Money Retirement Savings Plan

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.