Tax Benefits of New Yorks 529 Plan. The funds offered include Vanguard.

Cheapscholar Orgnow Is The Time To Save For College In New York Cheapscholar Org

Take a closer look at how to pay for college using a tax-favored savings option such as a 529 plan with the College Savings Planner from Vanguard manager of NYs 529 College Savings Program direct plan.

529 college savings plan ny. New Yorks 529 College Savings Program Direct Plan education savings specialists are available to provide assistance Monday through Friday from 8 am. New Yorks 529 College Savings Program. New Yorks 529 College Savings Program.

Learn more though the programs frequently asked questions. Visit NYs 529 College Savings Plan website to learn more Learn who administers the NYSAVES Direct Plan and Advisor Plan 1 Earnings on nonqualified withdrawals may be subject to federal income tax and a 10 federal penalty tax as well as state and local income tax. The New York 529 Direct Plan offers college savers a comprehensive swath of portfolios that certainly cover a broad spectrum of performance expense ratios and other advantages all.

Through NYs 529 College Savings Program you can save on taxes while you save for college. New York State single filers can deduct up to 5000 in annual contributions when calculating their New York state income tax. Direct this 529 plan can be purchased directly through the state.

New Yorks 529 program customer service representatives will be able to answer general questions about New Yorks 529 College Savings Program as well as any specific questions about withdrawal policies and procedures. This plan offers a variety of investment options including age-based portfolios that become more conservative as the child approaches college and static investment fund options. 529 plan funds can be used at any accredited college or university across the nation including some K-12 private schools.

If you live in New York and are planning to put a child through college you can receive a substantial tax deduction by contributing to New Yorks 529 College Savings Program. Where do enter I enter New York 529 Plan Contributions. Whether youre a parent grandparent or someone with a special child in your life New Yorks.

This temporary schedule change will be in place until further notice. 529 plans offer tax-advantaged ways to save money because investments made in these accounts grow tax-free and all withdrawals used for qualified higher education expenses are exempt from federal income tax. Navigate to Screen 51091 New York Modifications.

To 8 pm Eastern time. Enter the dollar amount in the field College tuition savings deduction code 9. New Yorks 529 College Savings Program NY529 is the name of New Yorks 529 Plan.

For more information about New Yorks 529 College Savings Program Direct Plan download a Disclosure Booklet and Tuition Savings Agreement or request one by calling 877-NYSAVES 877-697-2837. The funds offered include Vanguard. New Yorks 529 College Savings Program NY529 is the name of New Yorks 529 Plan.

It is important to note that your child does not have to go to a NY college or university in order to use this savings account. Who can answer student or parent questions about their NYS 529 College Savings Plan. New York has its own state-operated 529 plan called New Yorks 529 College Savings Program.

To enter a 529 Plan Contribution. Students and parents can call the NYS Saves phone number. If the taxpayer made contributions as the account owner to one or more.

Plus enter for a chance to win one of four 500 gift cards that can be put in any 529 account. Scroll down to the section New York Subtractions. Married couples filing jointly can deduct up to 10000 in contributions.

Investment returns are not guaranteed and you could lose money by investing in the Direct Plan. This document includes investment objectives risks charges expenses and other. This plan offers a variety of investment options including age-based portfolios that become more conservative as the child approaches college and static investment fund options.

New Yorks 529 College Savings Program offers some decent tax protections. This holiday season give the gift of prevention a 529 college savings plan. NYs 529 College Savings Program Direct Plan.

New Yorks 529 College Savings Program is a traditional 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified education expenses. New Yorks 529 Advisor-Guided College Savings Program is a college savings plan sponsored by the State of New York that provides a tax-advantaged way for.

529 Myths The Real Story Ny 529 Direct Plan

529 Myths The Real Story Ny 529 Direct Plan

Ny 529 Direct Plan Account Nyc Kids Rise

Ny 529 Direct Plan Account Nyc Kids Rise

Does Your State S 529 Plan Pay For Itself Morningstar

Does Your State S 529 Plan Pay For Itself Morningstar

More Saving Less Borrowing With Ny 529 Direct College Savings Plan Ny529edu New Mommy Bliss

More Saving Less Borrowing With Ny 529 Direct College Savings Plan Ny529edu New Mommy Bliss

New York Ny 529 College Savings Plans Saving For College

New York Ny 529 College Savings Plans Saving For College

Start Early To Prepare Your Child For College Ny 529 Direct Plan

Start Early To Prepare Your Child For College Ny 529 Direct Plan

New York S 529 College Savings Program Direct Plan New York 529 College Savings Plan Ratings Tax Benefits Fees And Performance

New York S 529 College Savings Program Direct Plan New York 529 College Savings Plan Ratings Tax Benefits Fees And Performance

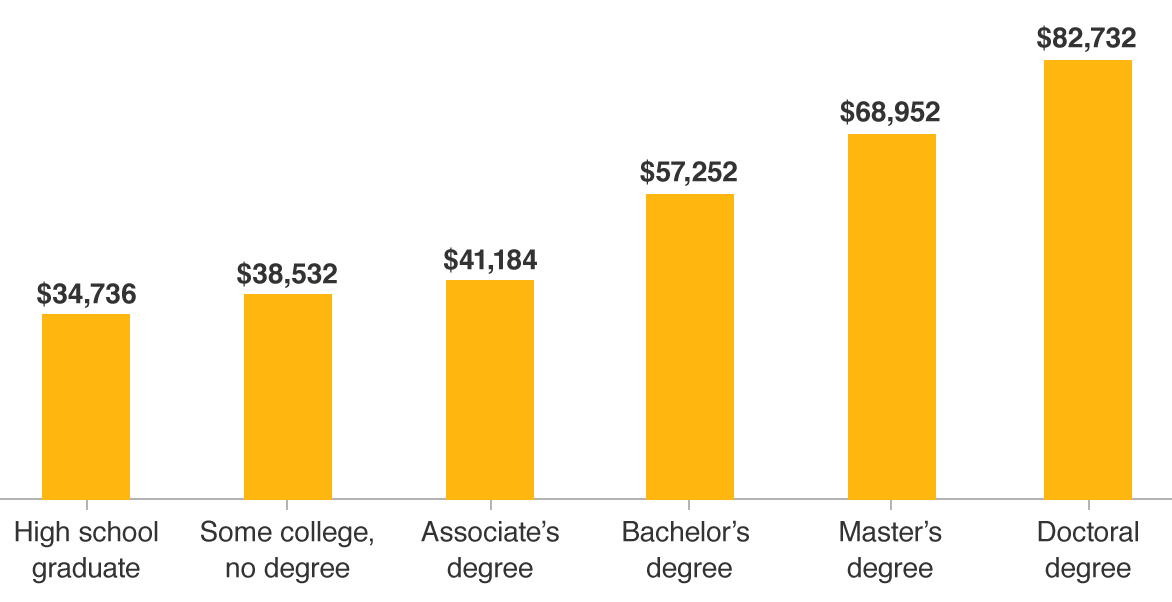

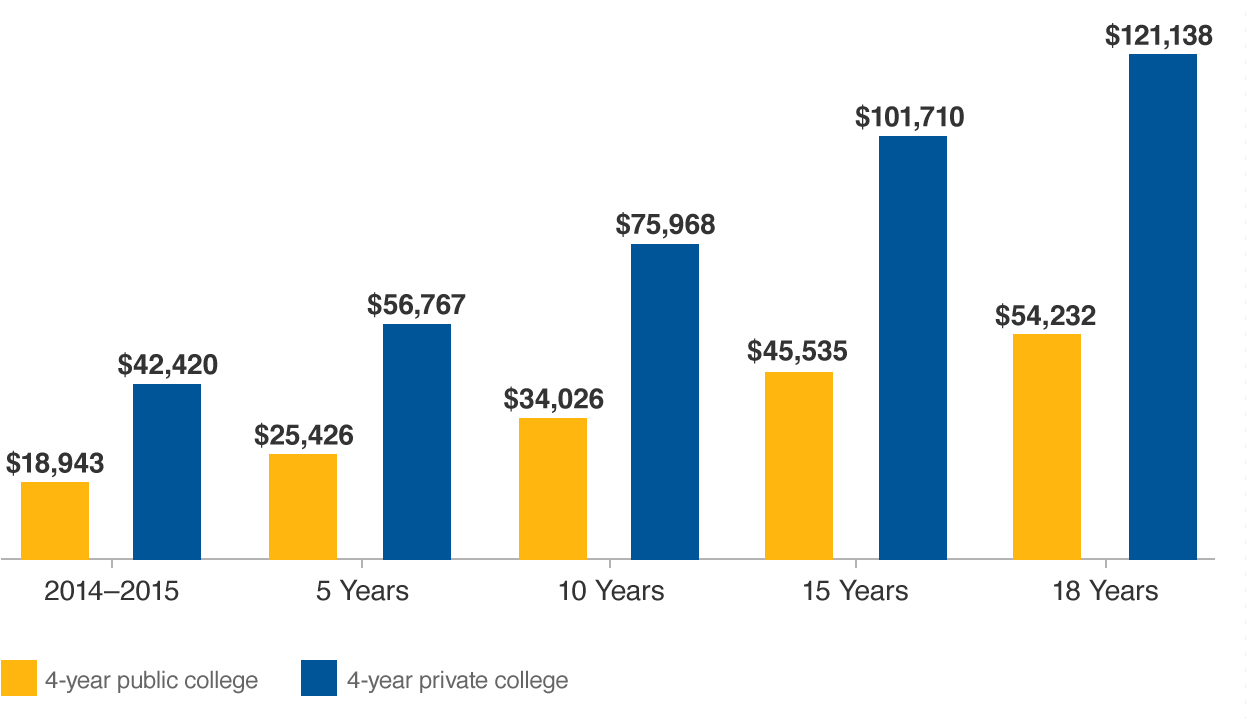

Cost Of College Ny 529 Direct Plan

Cost Of College Ny 529 Direct Plan

529 Plans Make Saving For College Easier Even When Money Is Tight

529 Plans Make Saving For College Easier Even When Money Is Tight

Ny 529 College Savings Program Digital Out Of Home Advertising All Points Media

Ny S 529 College Savings Program Ny 529 Direct Plan

Ny S 529 College Savings Program Ny 529 Direct Plan

Ny S 529 College Savings Program Ny 529 Direct Plan

Ny S 529 College Savings Program Ny 529 Direct Plan

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.