Blind Persons Tax Credit. However taxpayers cant get the break if.

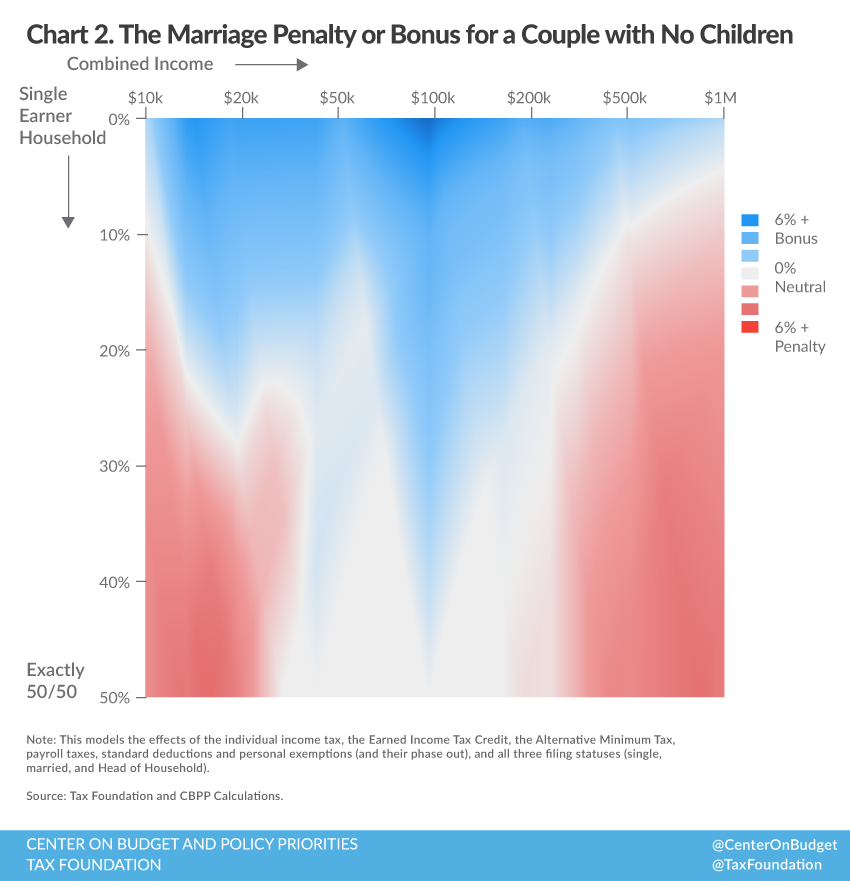

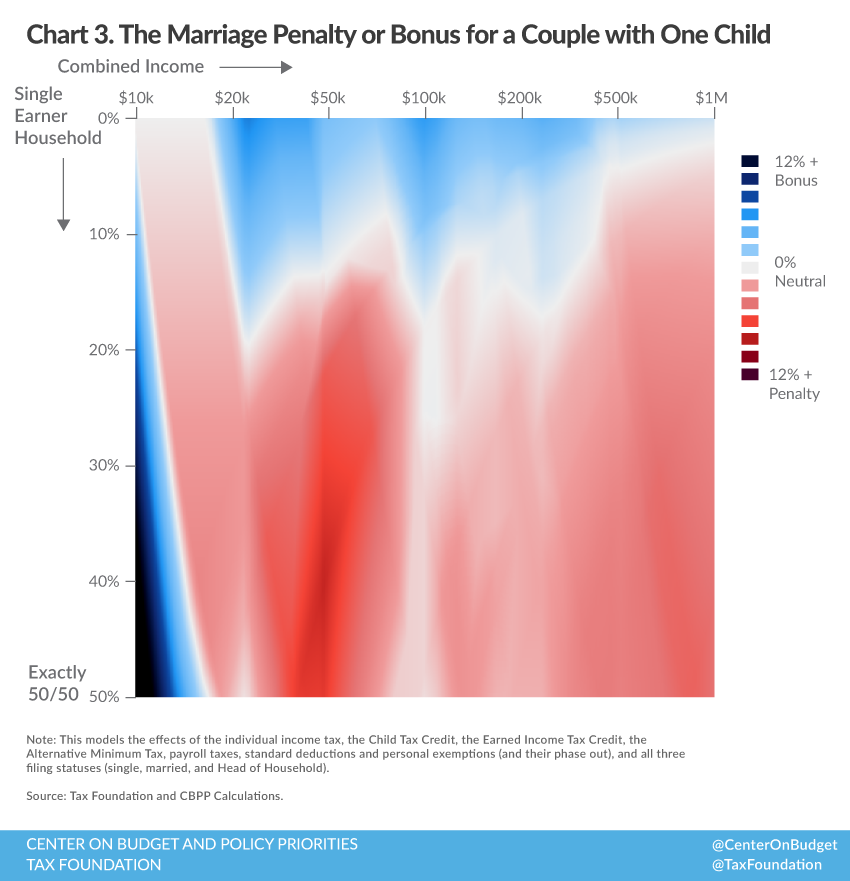

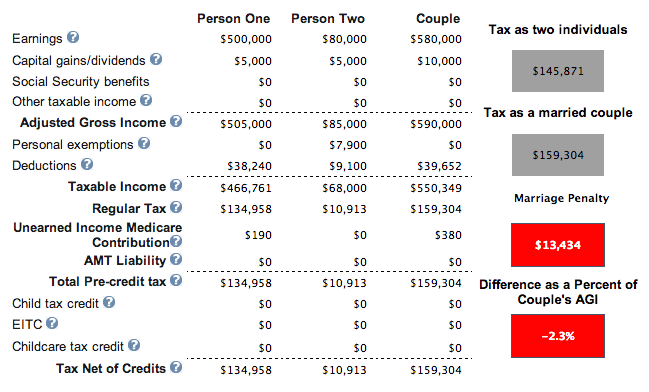

Understanding The Marriage Penalty And Marriage Bonus Tax Foundation

Understanding The Marriage Penalty And Marriage Bonus Tax Foundation

Widowed person or surviving civil partner with dependent children 1650.

Tax breaks for married couples without a child. Widowed Person or Surviving Civil Partner with dependent children 1650. Incapacitated Child Tax Credit. The tax burden examples for married couples assume one spouse earns 65000 in wages while the other makes 35000 and takes graduate classesThe couple.

Widowed Person or Surviving Civil Partner - bereavement year. The difference between separate assessment and assessment as a single person is that some tax credits are divided equally between you under the separate assessment option. Married couples qualify if they dont make more than 110000 and single parents qualify if they dont make more than 75000.

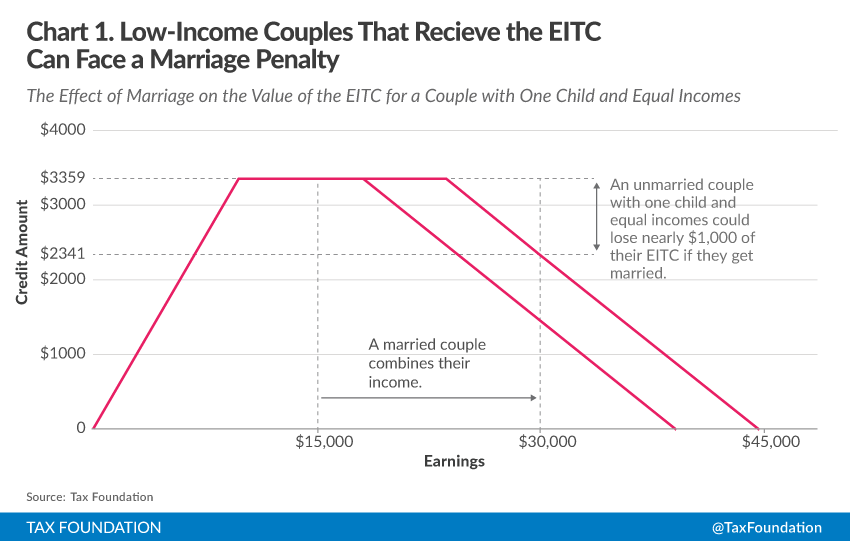

Resident aliens may be eligible for up to 1800 in tax credits if filing single 3600 in tax credits if filing married filing jointly and 1100 tax credits per eligible child under age 17 as long as they meet the other requirements. They might also have been living as an unmarried couple for tax credit purposes prior to this date. For example a married couple with one child will no longer qualify for the EIC once their income exceeds 47646 for tax year 2020.

It would have applied. This is because taxpayers are no longer eligible for the EIC once their income exceeds a certain level which is based on how many children they have. From the date on which a couple marry they will be treated as a married couple for tax credit purposes even if they do not begin living in the same household.

Married Person or Civil Partner. The child tax credit is better than the deductions because your taxes are reduced dollar for dollar. Married person or civil partner.

The first of the two exceptions is fairly straightforward. Claiming this credit gives an additional 2000 for children under 17. In April the Conservatives outlined plans to give four million married couples and civil partners an annual 150 tax break.

Widowed person or surviving civil partner -. Child and Dependent Care. Widowed person or surviving civil partner without dependent children 2190.

These tax credits are. Age Tax Credit. Widowed Person or Surviving Civil Partner without dependent children 2190.

The tax benefit applies per person meaning a married couple can exclude a maximum 20400 from income tax. Married or Civil Partners Tax Credit.

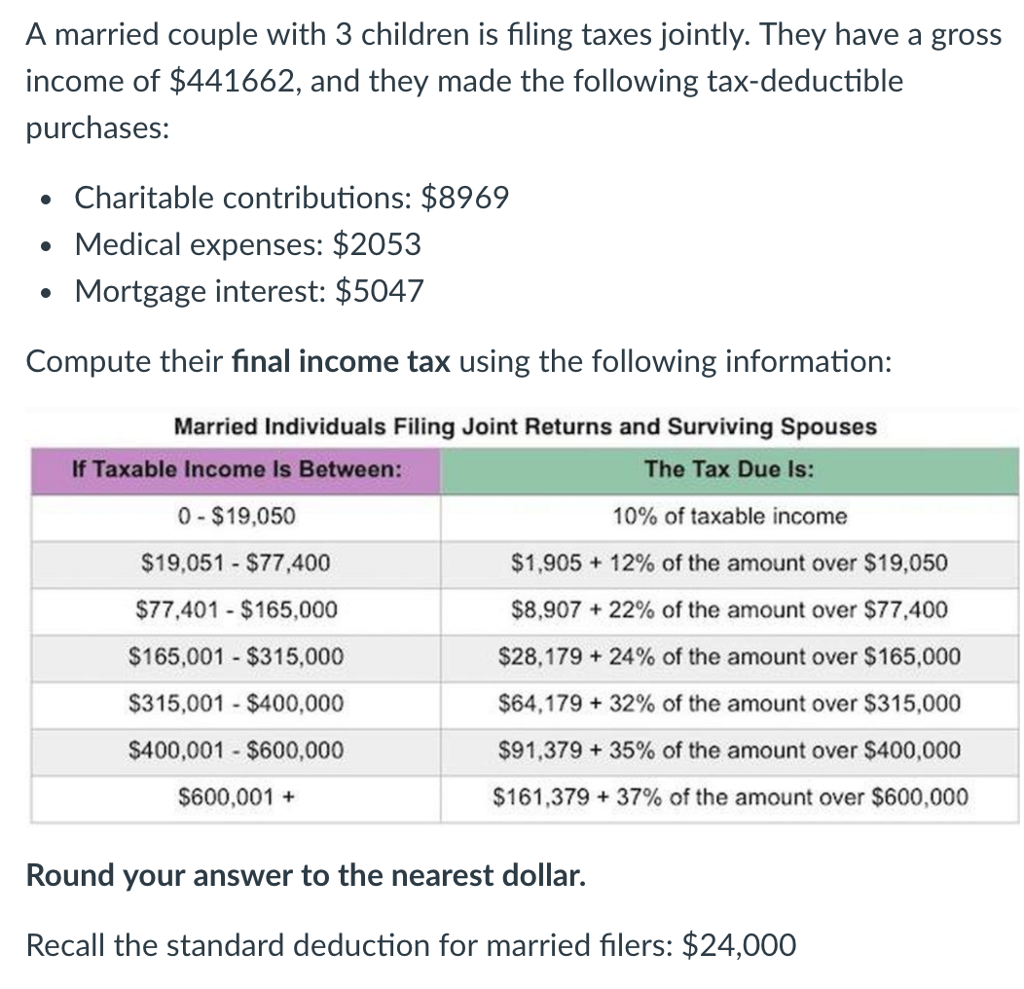

Solved A Married Couple With 3 Children Is Filing Taxes J Chegg Com

Solved A Married Couple With 3 Children Is Filing Taxes J Chegg Com

What Parents Should Know About Children And Taxes Taxes Us News

What Parents Should Know About Children And Taxes Taxes Us News

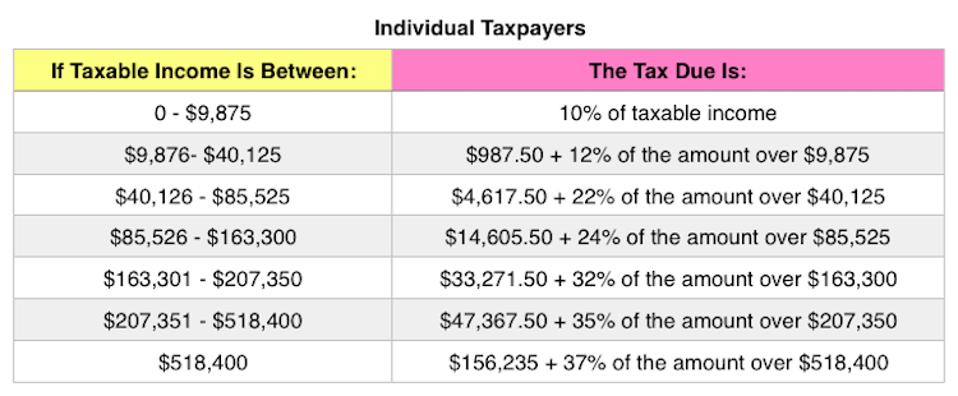

2018 Irs Federal Income Tax Brackets Example Married No Kids My Money Blog

2018 Irs Federal Income Tax Brackets Example Married No Kids My Money Blog

Understanding The Marriage Penalty And Marriage Bonus Tax Foundation

Understanding The Marriage Penalty And Marriage Bonus Tax Foundation

7 Tax Benefits For Married Couples You Need To Know For 2021

7 Tax Benefits For Married Couples You Need To Know For 2021

7 Tax Benefits For Married Couples You Need To Know For 2021

7 Tax Benefits For Married Couples You Need To Know For 2021

Understanding The Marriage Penalty And Marriage Bonus Tax Foundation

Understanding The Marriage Penalty And Marriage Bonus Tax Foundation

At What Income Level Does The Marriage Penalty Tax Kick In

At What Income Level Does The Marriage Penalty Tax Kick In

Single Married Or Cohabiting Who Pays The Least Tax

Single Married Or Cohabiting Who Pays The Least Tax

Iras Tax Savings For Married Couples And Families

Iras Tax Savings For Married Couples And Families

The Status Of The Marriage Penalty An Update From The Tax Cuts And Jobs Act The Cpa Journal

The Status Of The Marriage Penalty An Update From The Tax Cuts And Jobs Act The Cpa Journal

What Are Marriage Penalties And Bonuses Tax Policy Center

What Are Marriage Penalties And Bonuses Tax Policy Center

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More Tncpa

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More Tncpa

At What Income Level Does The Marriage Penalty Tax Kick In

At What Income Level Does The Marriage Penalty Tax Kick In

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.