A reverse mortgage uses a home equity conversion loan to provide older Americans with cash flow. If youre retiring without substantial savings Social Security will probably be your primary source of retirement income.

How To Retire At 62 With Little Money It S About Value Rebel Retirement

How To Retire At 62 With Little Money It S About Value Rebel Retirement

Your retirement money doesnt have to stretch as far.

How to retire at 62 with little money. One way to retain a semblance of this lifestyle and sustain retirement without savings is to work a part-job in retirement that helps pay for essential expenses but still leaves you with time for other pursuits you had in mind for retirement such as volunteering. 512 of 1 for each month that exceeds 36 months. Your 62nd birthday has just arrived and with it came an overwhelming temptation to retire.

The upside of filing at 62. The best way to get a complete understanding of self-reliance and how it applies to retirement is to read my article What is a Self-Reliant Retiree. If you can manage it get a job that offers benefits such as paid leave which may allow you to splurge on activities such as travel on occasion.

Protect your future income by making a smart decision about when to begin your Social Security which provides inflation-adjusted income for as long as you live. And while the extra cash will certainly help just as importantly working a little during retirement will give you something to do with your time thus preventing you from spending money. However this triggers a reduction in your benefit amount.

Many retirees say they fear running out of money. You have to be 62 or older own your home or have a low mortgage balance be able to afford property taxes and home insurance and live in the home. Being self-reliant is an essential ingredient to a successful retirement at 62 with little money.

You can enjoy higher Social Security benefits. Dont Wait - Try Searching Today. Ad We Can Help You Find Unclaimed Money In Your Name.

You can continue to contribute to your retirement savings. If they start taking Social Security benefits now at 62 they will only get 75 benefits. Using the example above the benefit amount would be reduced by 30 taking what would have been a theoretical 1000 monthly payment to 700.

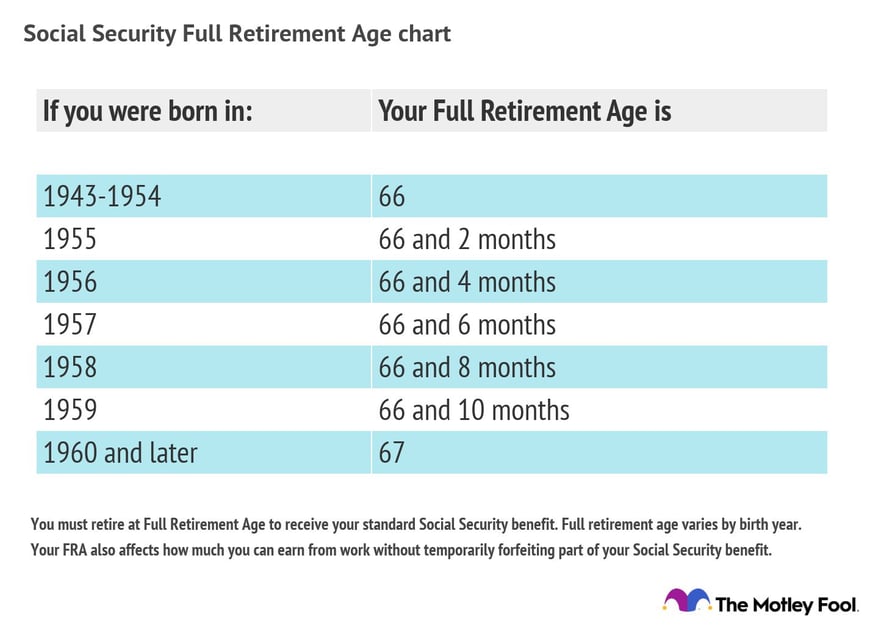

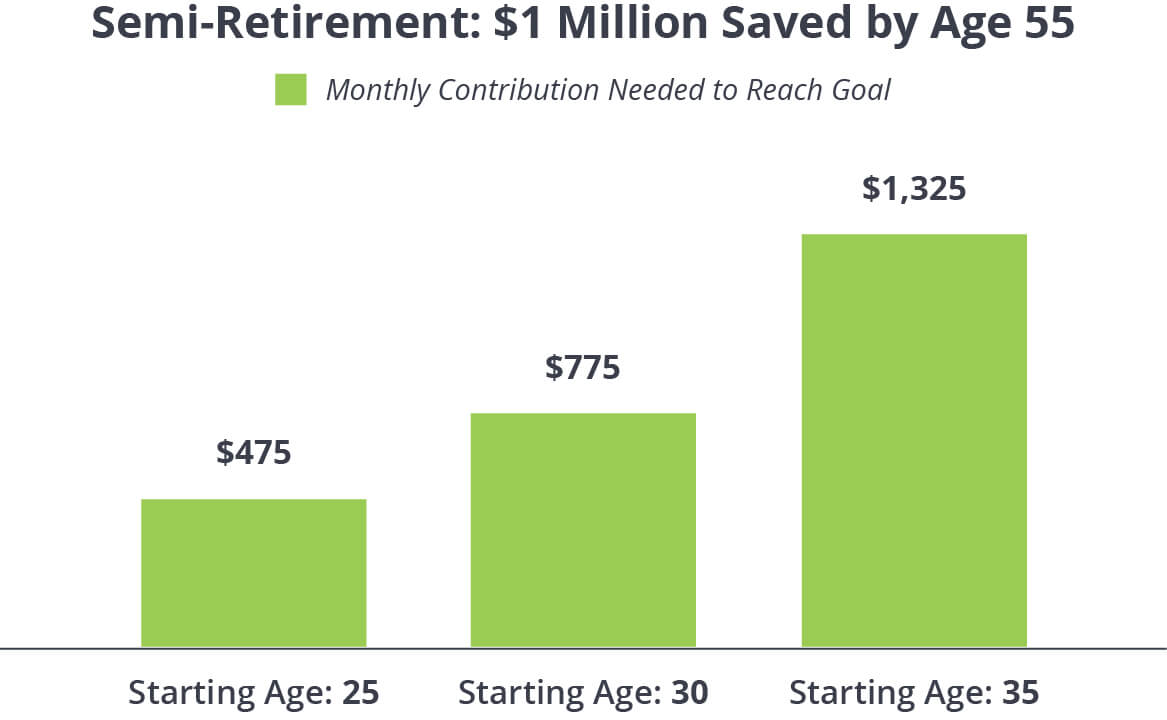

Most People Dont Know That The State Could Be Holding Unclaimed Money In Their Name. If your FRA is 66 filing at 62 will constitute a 25 hit to. For example my parents will be 66 in 4 years.

Get Out of Debt. Dont Wait - Try Searching Today. Claiming Social Security at 62 means subjecting yourself to the maximum reduction in benefits you can face.

Delay Your Social Security Benefits. Ad We Can Help You Find Unclaimed Money In Your Name. According to the rules of the Social Security Administration you are allowed to retire and claim benefits at the age of 62.

59 of 1 for each month before the FRA up to 36 months. For example if you were born in 1960 or later taking Social Security benefits at age 62 would reduce your monthly benefit by 30. The penalty for early retirement reduces the benefit amount by.

Taking benefits at age 62 or at any time between 62 and your full retirement age would reduce your benefit amount. Generally your Social Security benefit increases roughly 7 to 8 for each year you postpone Social Security between the ages of 62 and 70. You may receive benefits as early as age 62.

Just because you retire at 62 it doesnt mean you have to start collecting Social Security. The amount of the reductiondepends on the year you were born. Most People Dont Know That The State Could Be Holding Unclaimed Money In Their Name.

But as you probably already know just because you may do something doesnt necessarily mean you should do it.

How Much Money Do I Need To Save To Retire At 62 Goodlife

How Much Money Do I Need To Save To Retire At 62 Goodlife

Retire At 62 With Little Money Retirement Retirement Planning Money

Retire At 62 With Little Money Retirement Retirement Planning Money

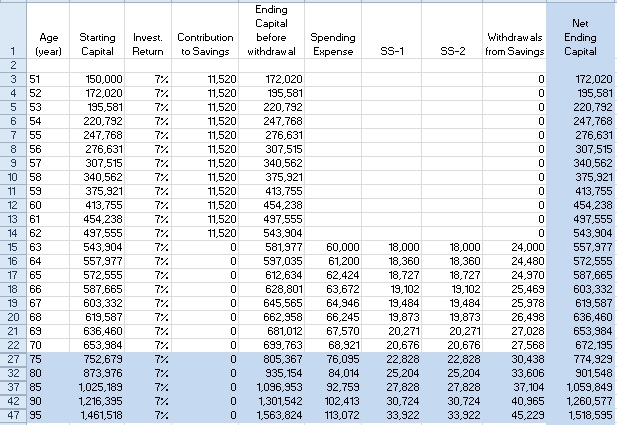

How Much Singaporeans Need To Save Now To Retire At 55 Or 62 Years Old

How Much Singaporeans Need To Save Now To Retire At 55 Or 62 Years Old

Full Retirement Age For Getting Social Security The Motley Fool

Full Retirement Age For Getting Social Security The Motley Fool

How Much Money Do I Need To Save To Retire At 62 Goodlife

How Much Money Do I Need To Save To Retire At 62 Goodlife

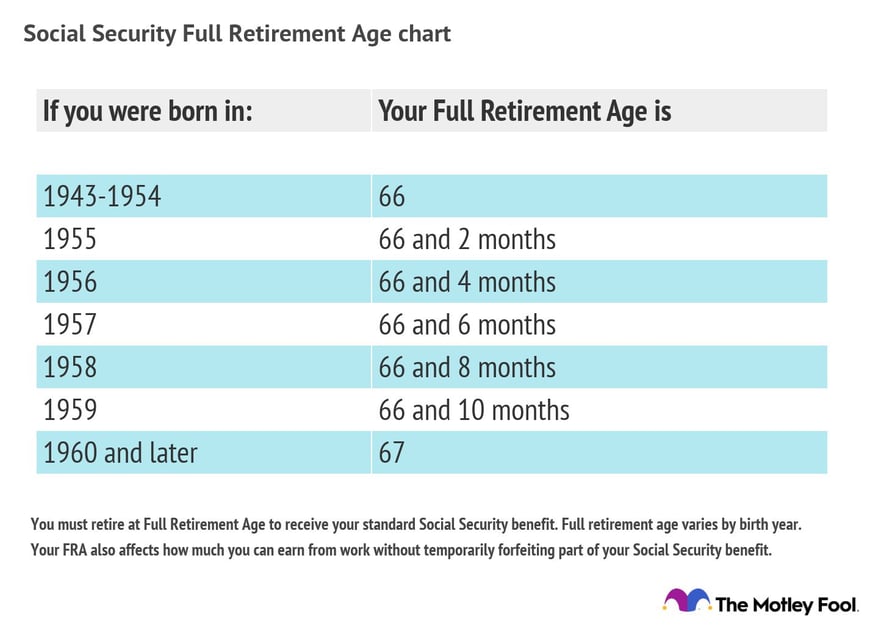

How To Save And Invest For Retirement At 62 Seeking Alpha

How To Save And Invest For Retirement At 62 Seeking Alpha

I M A 57 Year Old Nurse With No Retirement Savings And I Want To Retire Within Seven Years What Can I Do Marketwatch

I M A 57 Year Old Nurse With No Retirement Savings And I Want To Retire Within Seven Years What Can I Do Marketwatch

/retiring-without-savings-at-60-years-old-91210a08a6f24b299d75c6e31ca0b937.gif) Retirement With No Savings At 60 Years Old

Retirement With No Savings At 60 Years Old

/social-security-retirement-benefits-while-working-2894597-v1-1cd7c45096a24f059e87116a5c8e6326.png) Social Security Retirement Benefits While Working

Social Security Retirement Benefits While Working

How To Retire At 62 With Just Half A Million Seeking Alpha

How To Retire At 62 With Just Half A Million Seeking Alpha

How Much Money You Need To Retire Early And Live On Investment Income

Can I Retire Early Ramseysolutions Com

Can I Retire Early Ramseysolutions Com

How To Retire At 62 With Little Money It S About Value Rebel Retirement

How To Retire At 62 With Little Money It S About Value Rebel Retirement

How Much Money Do I Need To Save To Retire At 62 Goodlife

How Much Money Do I Need To Save To Retire At 62 Goodlife

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.