Your earnings test withholding will be based on that estimated amount. In 2020 workers receive one credit for every 1410 they earn.

How Does Social Security Work Top Questions Answered Ramseysolutions Com

How Does Social Security Work Top Questions Answered Ramseysolutions Com

It does not matter whether a surviving spouse worked long enough to qualify for Social Security on his or her own.

How do social security benefits work. The Social Security Administration explains how this works. Lets say that you file for Social Security benefits at age 62 in January 2021 and your payment will be 600 per month 7200 for the year. Social Security is a program run by the federal government.

Social Security helps older Americans workers who become disabled and families in which a spouse or parent dies. Depending on your relationship to the deceased and your age you may be eligible to receive his full monthly benefit. Social Security benefits are primarily funded through a dedicated payroll tax that was created by the Federal Insurance Contributions Act FICA.

As of June 2020 about 180 million people worked and paid Social Security taxes and about 65 million people received monthly Social Security benefits. If your spouse receives a spouses benefit based on your work record your retirement benefits are not reduced you receive the full amount of your benefit. Social Security works by pooling mandatory contributions from workers into a large pot and then paying out benefits to those who are eligible for them.

Social Security benefits for disabled people help to cover the living expenses for people who cannot reasonably be expected to hold an ordinary job and collect a livable wage. How Does Social Security Work How is it Funded. More File and Suspend Definition.

20 Workers are eligible for four credits a year. Social Security does not grant benefits to individuals with partial or short-term disabilities. The Real Purpose of Social Security.

During 2021 you plan to work and earn 23920 4960 above the 18960 limit. When you file for a Social Security benefit the SSA will ask you to estimate your earnings for that year. A widow or widower who has reached full retirement age and whose spouse did not receive Social Security benefits until 70 years old receives the full benefit amount of the deceased spouse.

Disability benefits on the other hand are paid to people who cannot work due to a medical condition that is expected to persist for at least one year or result in death. It can also support your legal dependents spouse children or parents with benefits in the event of your death. We would withhold 2480 of your Social Security benefits 1 for.

If you are below full retirement age and still working your survivor benefit could be affected by Social Securitys earnings limit. However Social Security also helps to allow people who cannot work live a dignified life as well. Most of our beneficiaries are retirees and their families.

Until recently any worker under the age of 70 who received Social Security retirement benefits and chose to return to work would lose a substantial portion of his or her Social Security benefits. You can claim a Social Security benefit based on your own earnings record or you can collect a spousal benefit that will provide you 50 percent of the amount of your spouses Social Security benefit as calculated at their full retirement age or FRA. Then once the year is over and your actual earnings amount is known you settle up with the SSA.

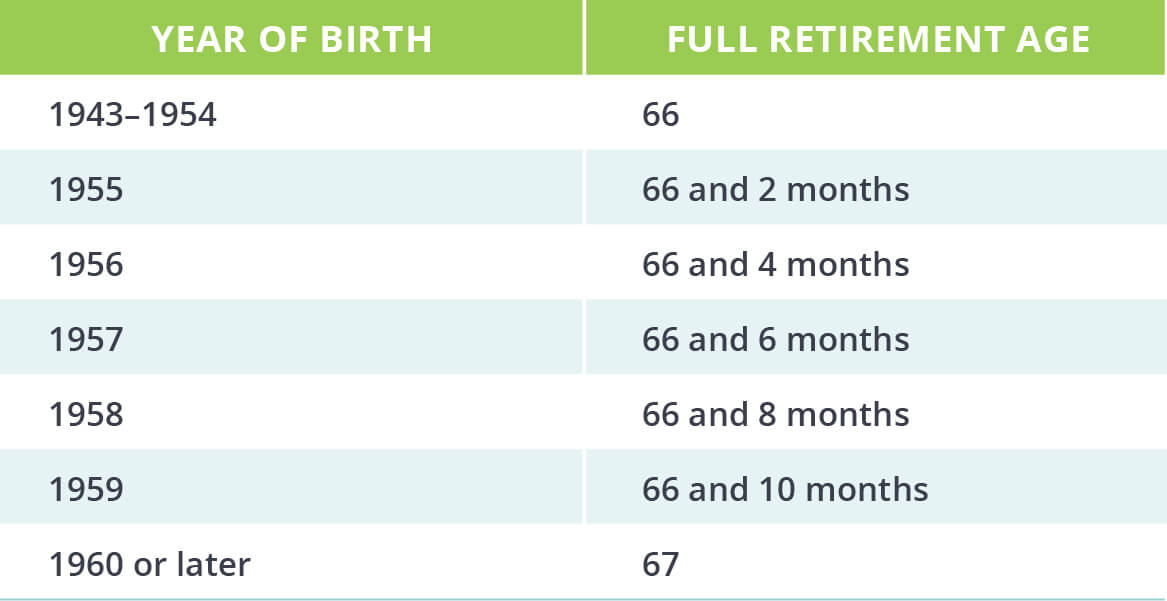

Youll need 40 of them over your wage-earning lifetime to receive Social Security benefits. Widowed spouses and former spouses who remarry before age 60 50 if they are disabled cannot collect survivor benefits. Check the Social Security website to determine your FRA as it depends on your year of birth.

Social Security benefits are payments made to qualified retirees and disabled people and to their spouses children and survivors. According to the AARP the average monthly Social Security benefit is 1543. Employees and employers each pay more than 6 of wages with a cap on the amount that is adjusted annually for growth in economy-wide wages.

Social Security will pay the higher of the two benefit amounts. Although the original purpose of. If you are already drawing Social Security on your work record you will receive survivor benefits only if they exceed your own payment.

He or she can still collect benefits on the deceased spouses work record. Social Security provides you with a source of income when you retire or if you cant work due to a disability. If you are also eligible for retirement benefits but havent applied yet you have an.

/social-security-benefits-calculation-guide-2388927-v3-dbb3bf3dcff4464ba6cf0871518c7059.png) How The Social Security Benefits Calculation Works

How The Social Security Benefits Calculation Works

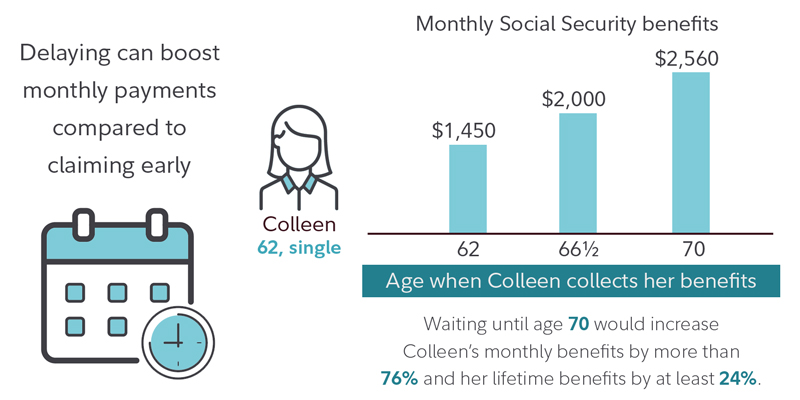

Social Security At 62 Fidelity

Social Security At 62 Fidelity

Howstuffworks How Social Security Works

How Does Social Security Work The Motley Fool

How Does Social Security Work The Motley Fool

Social Security Ssi Ssdi Moms In Motion At Home Your Way

Social Security Ssi Ssdi Moms In Motion At Home Your Way

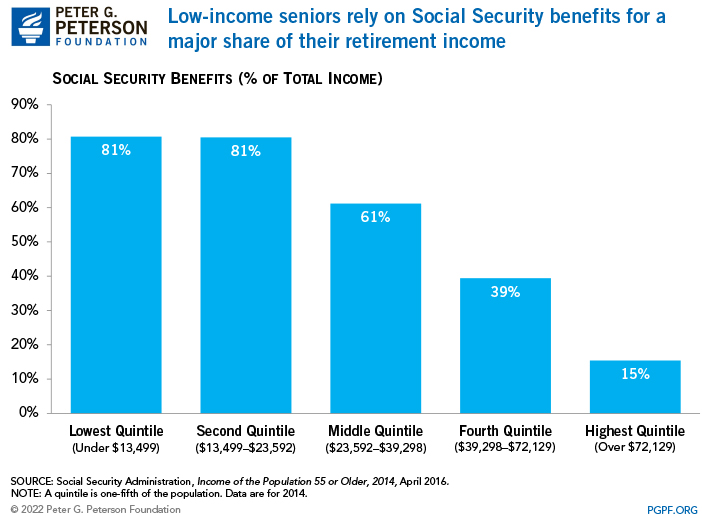

Budget Basics How Does Social Security Work

Budget Basics How Does Social Security Work

Social Security Benefits What You Need To Know Ramseysolutions Com

Social Security Benefits What You Need To Know Ramseysolutions Com

How Are Social Security Benefits Earned Infographic America Saves Week

How Are Social Security Benefits Earned Infographic America Saves Week

/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png) Learn About Social Security Income Limits

Learn About Social Security Income Limits

How To Find Out How Many Work Credits You Have To File A Claim For Disability Quora

:max_bytes(150000):strip_icc()/how-the-the-social-security-spouse-benefit-works-2388924-Final-454c6b7b12a44930bd8ab9c5d81a6102.png) Social Security Spousal Benefits What You Need To Know

Social Security Spousal Benefits What You Need To Know

8 Things Everyone Wants To Know About Social Security Becu

8 Things Everyone Wants To Know About Social Security Becu

/GettyImages-184358375-81456f521f944c6a95f83dd84ce8b06e.jpg) Social Security Benefits Definition

Social Security Benefits Definition

/social-security-retirement-benefits-while-working-2894597-v1-1cd7c45096a24f059e87116a5c8e6326.png) Social Security Retirement Benefits While Working

Social Security Retirement Benefits While Working

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.