5523 per gallon. From July 1 2020 through June 30 2021 the rates are as follows.

Gas Tax Rates July 2018 State Gas Tax Rankings Tax Foundation

Gas Tax Rates July 2018 State Gas Tax Rankings Tax Foundation

The national average state and local gasoline tax rate as of January 2020 is 317 per gallon which is 15 higher than was reported in January 2019.

Diesel fuel tax by state 2020. Statewide Fuel Taxes on Undyed Diesel Fuel Excise Sales 9th Cent Local Option SCETS Total All Counties 0040 0143 001 006 0079 0332 Statewide Fuel Taxes on Aviation Fuel State Tax Effective Date of Tax Rate All Counties 00427 July 1 2019 Exhibit B 2020 State Taxes Inspection Fee Ninth Cent Local Option. 3785 per gallon. 1115 per gallon.

1161 per gallon. The fuel tax credit calculator includes the latest rates and is simple quick and easy to use. Over the past ten years federal motor fuels tax revenue has not changed much and diesel tax revenue consistently represents about 40 percent of.

Additional District sales taxes may apply. Liquefied petroleum gas LPG 0462 per gallon 1. Here is a summary report on gasoline and diesel taxes.

Persons may claim a refund of the entire tax if the fuel was used for exempt purposes. Tax rates were also indexed on an annual basis through 2024. Rates for fuel acquired from 1 February to 30 June 2021.

All rates are in cents per litre unless otherwise stated. From 1 July 2020 to 30 June 2021. 51 rows In Connecticut diesel is exempt from gross receipts tax.

A 2017 state law increased the gas and diesel rates by 10 cents to 28 cents. Compare 2020 state fuel excise taxes by state 2020 gas tax rates by state and 2020 state gas tax rates with new map. The off-highway refund is 006 per gallon if the fuel was purchased at the 008 highway fuel rate.

The state of Indianas fuel tax rates also are on the rise. 2568 per gallon. For states that charge a.

52 rows See the current motor fuel tax rates for your state as of April 2020. You can use it to work out the fuel tax credit amount to report on your business activity statement BAS. Oil Spill Prevention and Administration Fee all products.

California pumps out the highest tax rate of 6247 cents per gallon followed by Pennsylvania 587 cpg Illinois 5201 cpg and Washington 494 cpg. Starting today the gas and diesel taxes are up 07 cents to 387 cents and 462 cents. The Diesel tax rate increased to 285 cents per gallon along with Biodiesel 31 - ALABAMA.

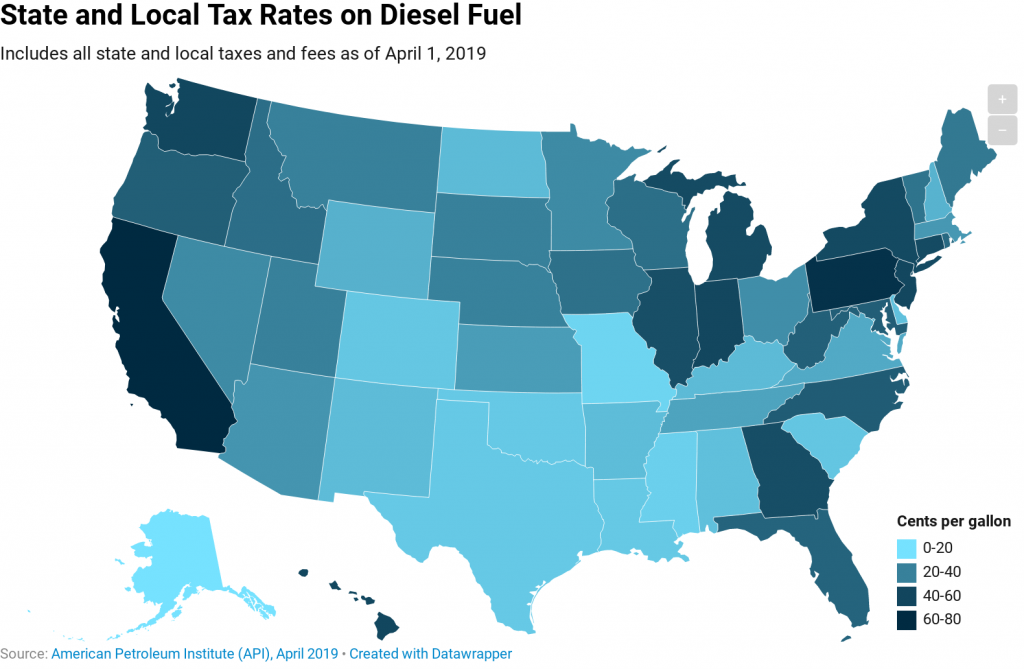

API collects motor fuel tax information for all 50 states and compiles a report and chart detailing changes and calculating a nationwide average. Notes for Diesel Fuel except Dyed Diesel Rates by Period. 6225 per gallon.

Total State and Federal Taxes. On top of excise taxes many states also apply fees and other taxes including environmental fees inspection fees load fees clean up fees along with LUST taxes license taxes and petroleum taxes. Total State TaxesFees 3683 per gallon.

When used off-road Dyed Diesel is taxed at the combined statewide sales tax rate plus applicable district taxesA partial exemption certificate provided in Regulation 1598 Motor Vehicle and Aircraft Fuels should be provided for this rate to apply. Gasolinegasohol 0387 per gallon. Washingtons 495 tax rate is similar to states with traffic congestion similar to ours California 606 Florida 423 New York 450.

0065 per barrel 000155gal. Compressed natural gas CNG 0387 per gallon 3 From July 1 2019 through June 30 2020 the rates are as follows. Multiple legislators already are taking steps to get enacted a fuel tax increase.

Dyed Diesel is not subject to Excise Taxes unless. In the United States the. For years elected officials in the Show-Me State have touted the need to come up with a long-term funding plan to help the state complete road and.

Diesel fuel 0462 per gallon. Liquefied natural gas LNG 0462 per gallon 2. About 40 percent of motor fuels taxes is derived from the sale of diesel fuel and other motor fuels such as natural gas and propane.

225 state sales tax on gasoline 900 state sales tax on diesel prepaid rates for these sales taxes. FEDERATION OF TAX ADMINISTRATORS -- JANUARY 2021 State Motor Fuel Tax Rates January 1 2021 GASOLINE DIESEL FUEL GASOHOL Excise FeeTax Total Excise FeeTax Total Excise FeeTax Total Notes Alabama 1 9 260 260 270 270 260 260 Alaska 80 095 895 80 095 895 80 095 895 Refining Surcharge. The Rebuild Alabama Act special session 2019-2 - Levies an incremental excise tax increase on gasoline and diesel fuel by 006 effective September 1 2019.

About a month remains until Missouri state lawmakers return to the capitol to gavel the 2020 legislative session. 2624 per gallon. The off-highway refund is 003 per gallon if the fuel was purchased at the 005 marine fuel rate.

State Underground Storage Tank fee all products. This report is updated quarterly. The rate increases by 006 on 9119 002 on 1012020 and 002 on 1012021.

2020 Diesel Sales Up 28 Boosting Truck Segment Fuel Economy. Motor Fuel Taxes State Gasoline Tax Reports. 51 rows Gas tax is different for gasoline diesel aviation fuel and jet fuel.

U S Diesel Fuel Taxes By State Impacts On Transportation Costs

File Federal And State Diesel Fuel Tax Png Wikimedia Commons

File Federal And State Diesel Fuel Tax Png Wikimedia Commons

Weekly Map State Gasoline Tax Rates Tax Foundation

Weekly Map State Gasoline Tax Rates Tax Foundation

Lowest Gas Tax And Prices In The U S By State 2020 Statista

Lowest Gas Tax And Prices In The U S By State 2020 Statista

State Motor Fuels Tax Rates Tax Policy Center

State Motor Fuels Tax Rates Tax Policy Center

U S Diesel Fuel Taxes By State Impacts On Transportation Costs

U S Diesel Fuel Taxes By State Impacts On Transportation Costs

What Is The Diesel Fuel Tax Rate In Your State Itep

What Is The Diesel Fuel Tax Rate In Your State Itep

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Api Releases Latest Report On Us And State Fuel Taxes Green Car Congress

Gas Tax By State 2020 Current State Diesel Motor Fuel Tax Rates

Gas Tax By State 2020 Current State Diesel Motor Fuel Tax Rates

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.