Partner with Us to Help Taxpayers. Spouses and dependents are eligible for.

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Search the worlds information including webpages images videos and more.

Irs boise idaho. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. You must also have your mailing address from your previous years tax return. To be considered a Partnership LLC Corporation S Corporation Non-profit etc.

See Publication 1546 The Taxpayer Advocate Service of the IRS PDF. Special Instructions for Filing Status and Mailing Address. IFTA returns Form 3150.

84 thoughts on IRS to Make ID Protection PIN Open to All Pt December 7 2020. If you cant resolve your situation with us. If you dont have a tax ID your employer will take more income tax from your salary 1 2 3.

For more information see Tax Topic 104. Income tax withholding Form 910 Form 967 and W-2s Form 1099 and file upload. If you move without notifying the IRS or the US.

In general anytime the wording self-employment tax is used it only refers to Social Security and Medicare taxes and not any other tax like income. Your Tax ID EIN will be delivered via E-Mail within 3 Business Days. Income tax withholding Form 910 Form 967 and W-2s Form 1099 and file upload.

Through TAP you can. Postal Service USPS your refund check may be returned to the IRS. Undelivered Federal Tax Refund Checks.

Ad Hadromi Partners is one of the prominent law firms in Indonesia. Ad Hadromi Partners is one of the prominent law firms in Indonesia. Every year the Internal Revenue Service IRS has millions of dollars in tax refunds that go undelivered or unclaimed.

Your employer needs your tax ID to calculate your income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. IFTA license renewal Form 3105.

IFTA returns Form 3150. IFTA license application Form IMC-2. Other commonly used terms for EIN are Taxpayer Id IRS Number Tax Id Taxpayer Identification Number TIN etc.

Through TAP you can. What to Do If You Cant Resolve Your Issue. IFTA license application Form IMC-2.

149 - Rush Delivery Your Tax ID EIN will be delivered via E-Mail within 1 Business Day. If you are outside of the Boise area call 877-777-4778. 1040 and Schedules 1-3 Individual Tax Return Other 1040 Schedules Information About the Other Schedules Filed With Form 1040 Form 4868 Application for Automatic Extension of Time to File.

Refund checks are mailed to your last known address. Auditorium districts Form 1250 4150 or 4250. Have employees Operate your business as a Corporation or Partnership Operate as Trust Estate or Non-Profit.

You do not need a tax ID to start working but some employers do not know this. Your tax ID is permanent it never changes. It is issued either by the Social Security Administration SSA or by the IRS.

Estate of Deceased Individual Tax ID In order to represent an estate that operates as a business after an owners death you need to file for a federal tax ID number. A Form W-2 or 1099 is not an income tax return. You will get that money back when you file a tax return 1 2.

Start Your Tax ID EIN Application Sole Proprietor Individual Limited Liability Company LLC Estate Trust Corporation Partnership Church Organization Non-Profit Organization S-Corporation Personal Service Corporation Who Needs an EIN You will need a Tax ID EIN if you. All our 2020 individual income tax forms and instructions 2020 Form 51 Estimated Payment of Individual Income Tax 2020 08-27-2020 Form ID-MS1 Employees Idaho Military Spouse Withholding Exemption Certificate 2021 02-07-2020 Form ID-POA Power of Attorney 12-17-2019 Form ST-101 Sales Tax Resale or Exemption Certificate 07-13-2020. E911 Fee Form 3950.

Other IFTA-related actions IFTA additional decal order Form 3104. E911 Fee Form 3950. 199 - Expedited Delivery Your Tax ID EIN will be delivered via E-Mail in 60 Minutes.

IFTA license renewal Form 3105. A Taxpayer Identification Number TIN is an identification number used by the Internal Revenue Service IRS in the administration of tax laws. The income tax return form 10401040-PR 1040-NR 1040-SR etc for the year shown on the letter Note.

Auditorium districts Form 1250 4150 or 4250. Other IFTA-related actions IFTA additional decal order Form 3104. If you are in the Boise area call the Taxpayer Advocate Service at 208-363-8900.

Google has many special features to help you find exactly what youre looking for. From IRS You must pass a rigorous identity verification process. A Social Security number SSN is issued by the SSA whereas all other TINs are issued by the IRS.

IRS-EIN-TAX-ID helps you get a tax ID number for business so that you can establish credit and start growing your company the way you envision. If you just filed a tax return with a new address. A business needs an EIN in order to pay employees and to file business tax returns.

Irs Accepts Installment Agreement In Boise Id 20 20 Tax Resolution

Irs Accepts Installment Agreement In Boise Id 20 20 Tax Resolution

Third Stimulus And Child Tax Credit Irs Needs Your 2020 Return Ktvb Com

Third Stimulus And Child Tax Credit Irs Needs Your 2020 Return Ktvb Com

500 Coronavirus Stimulus Irs Re Opens Filing For Some Parents Ktvb Com

500 Coronavirus Stimulus Irs Re Opens Filing For Some Parents Ktvb Com

Free State Federal Tax Filing Available For 600k Idahoans Idaho Statesman

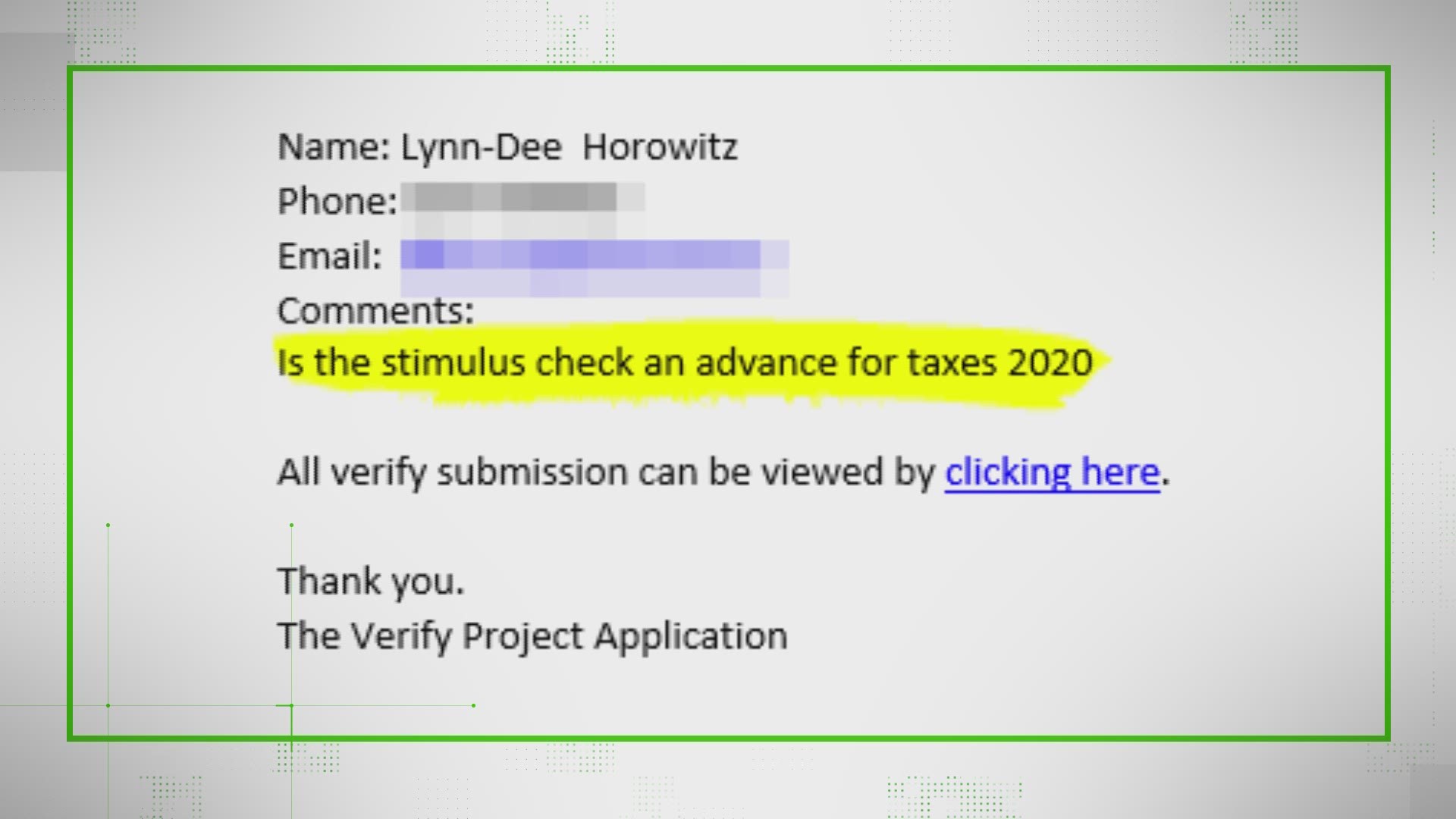

Irs Complaint Filed Against Idaho Freedom Foundation Local News 8

Irs Complaint Filed Against Idaho Freedom Foundation Local News 8

Us Judge Irs Can T Keep Coronavirus Money From Inmates

Us Judge Irs Can T Keep Coronavirus Money From Inmates

When Will Social Security Get Third Stimulus Files Sent To Irs Ktvb Com

When Will Social Security Get Third Stimulus Files Sent To Irs Ktvb Com

Idaho Freedom Foundation Accused Of Disobeying Irs Rules By Encouraging Idahoans To Disobey Governor Politics Magicvalley Com

Idaho Freedom Foundation Accused Of Disobeying Irs Rules By Encouraging Idahoans To Disobey Governor Politics Magicvalley Com

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Irs Approved Ce Idaho Society Of Certified Public Accountants Iscpa

Irs Approved Ce Idaho Society Of Certified Public Accountants Iscpa

Irs Free File Service Available To Taxpayers With 2020 Income 72 000 And Below Local News 8

Irs Free File Service Available To Taxpayers With 2020 Income 72 000 And Below Local News 8

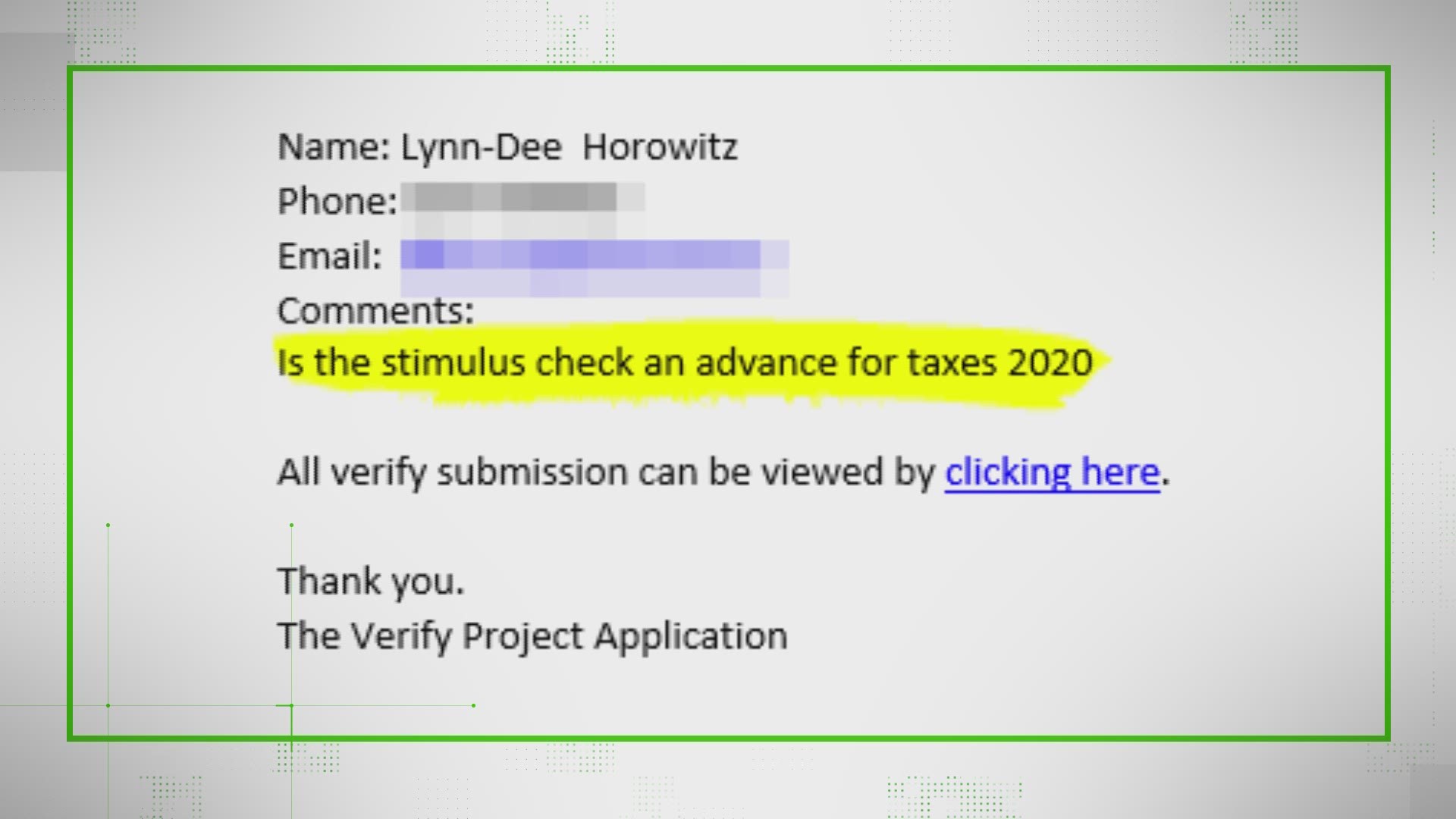

Irs Complaint Filed Against Idaho Freedom Foundation For Stay At Home Order Protests Boise State Public Radio

Irs Complaint Filed Against Idaho Freedom Foundation For Stay At Home Order Protests Boise State Public Radio

Irs Complaint Filed Against Idaho Freedom Foundation For Stay At Home Order Protests Boise State Public Radio

Irs Complaint Filed Against Idaho Freedom Foundation For Stay At Home Order Protests Boise State Public Radio

Don T Throw Out That Envelope With The Treasury Department Seal On The Outside East Idaho News

Don T Throw Out That Envelope With The Treasury Department Seal On The Outside East Idaho News

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.