Please note that if you choose to open your own college savings account in the NY 529 Direct Plan you must be a US. The account comes with real tax advantages and an additional incentive that motivated us to choose 529 is that any investment earnings are not subject to federal and state taxes if the money is used for the educational needs of the specified beneficiary for example tuition books and college accommodation.

Ny 529 Direct Plan On Twitter Happy Birthday To All January Kids If Your Gift Wrapping Fingers Are Tired Why Not Set Up An Ny 529 College Savings Account For Them Https T Co Oqfiwfpond Https T Co 4b7odaw8ab

Ny 529 Direct Plan On Twitter Happy Birthday To All January Kids If Your Gift Wrapping Fingers Are Tired Why Not Set Up An Ny 529 College Savings Account For Them Https T Co Oqfiwfpond Https T Co 4b7odaw8ab

Benefits of 529 Plan.

529 direct plan. New Yorks 529 College Savings Program currently includes two separate 529 plans. All checks must be payable to CollegeChoice 529 Direct Savings Plan. Get Results from 6 Engines at Once.

You may also participate in the Advisor-Guided Plan which is sold exclusively through financial advisors and has different investment options and higher fees and expenses as well as financial advisor compensation. Get Results from 6 Engines at Once. In fact Morningstars annual 529 research report released in May found that American families chose direct- and advisor-sold plans nearly equally.

NY 529 Direct Plan and Taxes. Investment returns are not guaranteed and you could lose money by investing in the Direct Plan. You can open your account s with as little as 25 and make additional contributions for a minimum of 15.

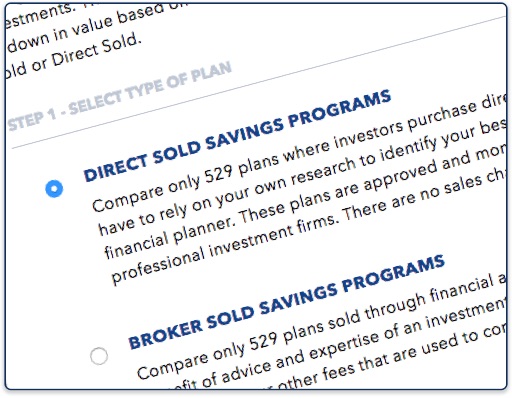

The Direct Plan is sold directly by the Program. Direct-sold 529 plans are convenient and generally offer low fees but the account owner is responsible for selecting and monitoring the 529 plans investments. Rollover from another 529 plan or Coverdell Education Savings Account to a CollegeChoice 529 Account.

No advisor fees commissions or account maintenance fees which other plans may charge. With a 529 plan youre allowed to change the beneficiary at any time to one of your beneficiarys eligible relatives. Benefits of using a direct-sold 529 plan.

Ad Search About 529 Plans. Examples include siblings and step siblings parents cousins aunts and uncles and in-laws. NYs 529 Direct Plan has some of the lowest costs available for 529 plans.

Read and consider it carefully before investing. 31 2013 advisor-sold plans. You will have to rely on your own research to identify your best options or you can hire a fee-based financial planner.

For more information about New Yorks 529 College Savings Program Direct Plan download a Disclosure Booklet and Tuition Savings Agreement or request one by calling 877-NYSAVES 877-697-2837. Spouses of these family members are often considered eligible beneficiaries as well. 63 rows A 529 plan is a state-sponsored savings plan that allows parents to invest funds that.

Read and consider it carefully before investing. Direct-sold 529 plans are approved and monitored by each state. Direct-sold 529 plans allow investors to purchase directly from the plan manager.

Our self-directed 529 plan lets you choose from a wide range of investments while offering tax benefits and the ability to manage the account the way you want. Simplify investing for college with NextGen 529 Direct Merrill offers the NextGen 529 Direct to help you set aside money for higher education expenses. Citizen or a resident alien with a verified permanent US.

You pay only 130 in fees per year for every 1000 you invest in the plan 013 total annual asset-based fee. The Direct Portfolio Plan is our most popular and you can open your account online in just minutes. Both you and your child must have a valid Social Security Number or Individual Tax Identification Number to open an NY 529 Direct Plan account.

Option to open another account for the same child. This document includes investment objectives risks charges expenses and other information. By law rollovers between 529 plans for the same Beneficiary are permitted.

Ad Search About 529 Plans. The biggest advantage of using a direct-sold 529 plan over an advisor-sold 529 plan is that direct-sold 529 plans tend to have lower fees.

Compare 529 Plans Saving For College

Compare 529 Plans Saving For College

529 Myths The Real Story Ny 529 Direct Plan

529 Myths The Real Story Ny 529 Direct Plan

Ny 529 Direct Plan Highlights Ny 529 Direct Plan

Ny 529 Direct Plan Highlights Ny 529 Direct Plan

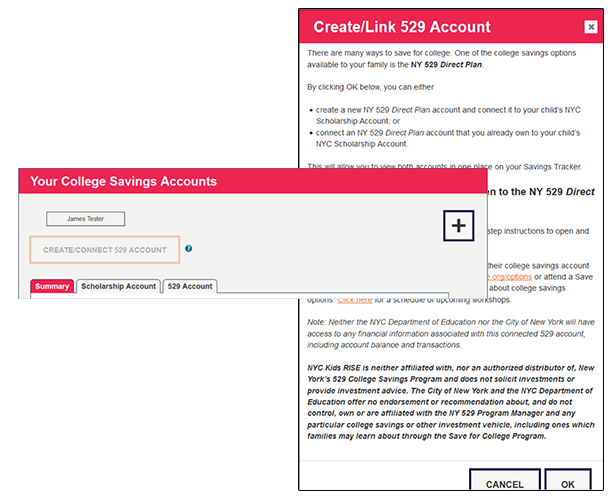

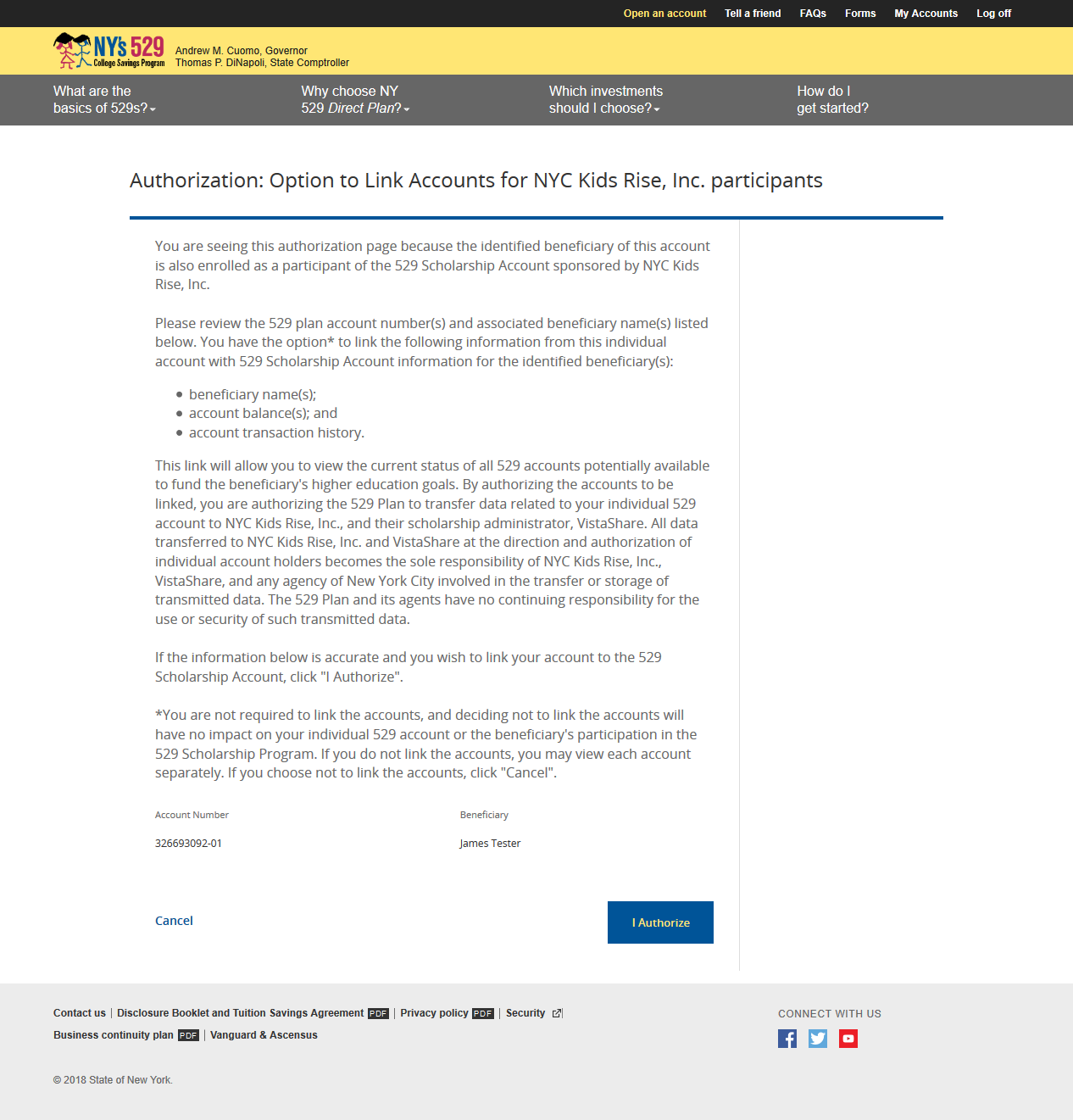

Ny 529 Direct Plan Account Nyc Kids Rise

Ny 529 Direct Plan Account Nyc Kids Rise

Ny 529 Direct Plan On Twitter Don T Panic These Simple Tools Will Help You Save Https T Co E7fttmjcfd

Ny 529 Direct Plan On Twitter Don T Panic These Simple Tools Will Help You Save Https T Co E7fttmjcfd

Avoid The Top 529 Plan Mistakes Ny 529 Direct Plan

Avoid The Top 529 Plan Mistakes Ny 529 Direct Plan

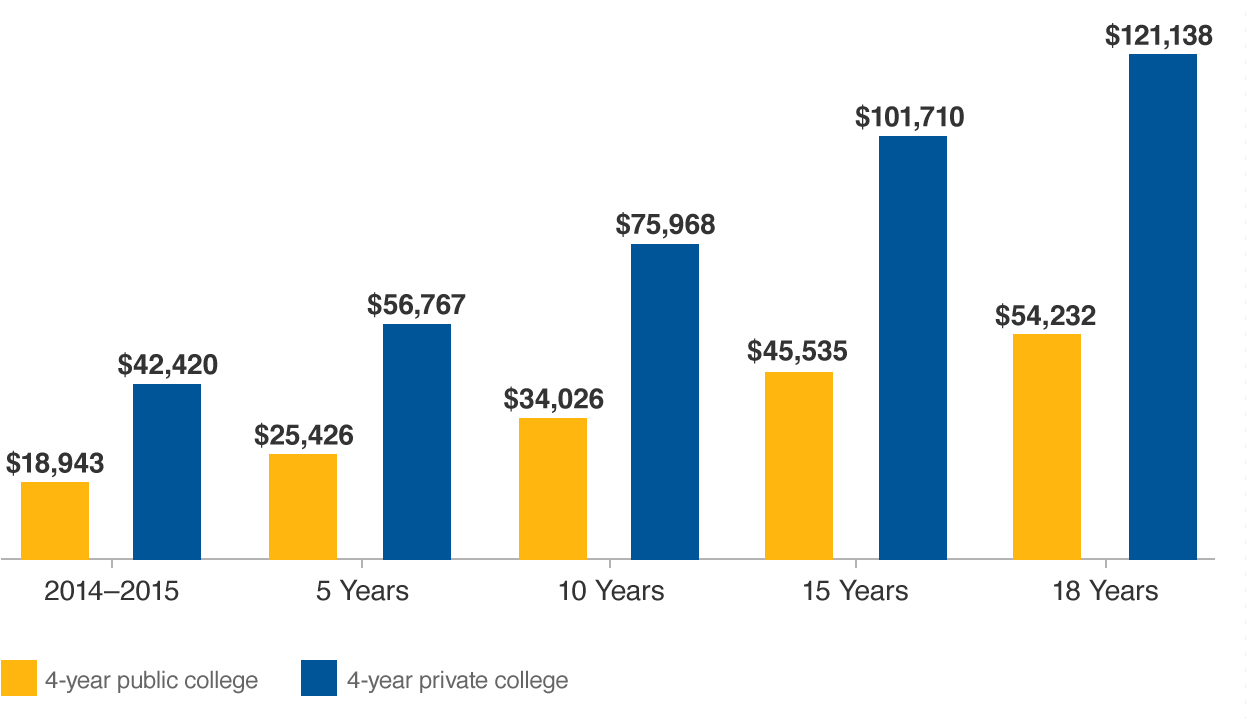

Cost Of College Ny 529 Direct Plan

Cost Of College Ny 529 Direct Plan

Ny 529 Direct Plan Ny529direct Twitter

Ny 529 Direct Plan Ny529direct Twitter

New York S 529 College Savings Program Direct Plan New York 529 College Savings Plan Ratings Tax Benefits Fees And Performance

New York S 529 College Savings Program Direct Plan New York 529 College Savings Plan Ratings Tax Benefits Fees And Performance

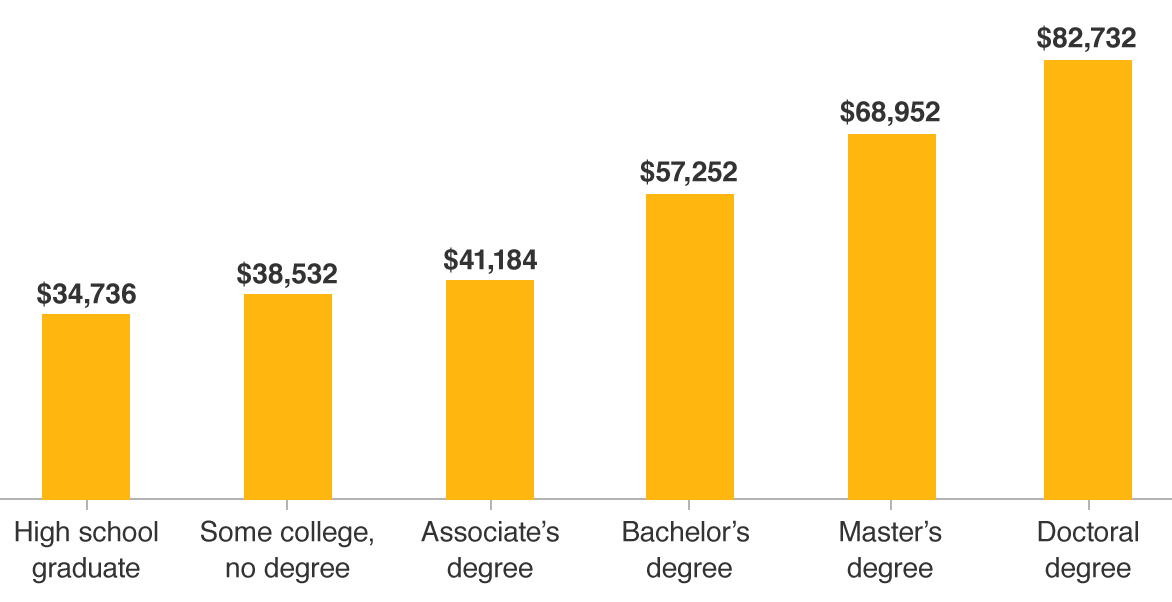

The Value Of A Degree Ny 529 Direct Plan

The Value Of A Degree Ny 529 Direct Plan

Ny 529 Direct Plan Account Nyc Kids Rise

Ny 529 Direct Plan Account Nyc Kids Rise

Collegechoice 529 Direct Savings Plan Indiana 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Collegechoice 529 Direct Savings Plan Indiana 529 College Savings Plan Ratings Tax Benefits Fees And Performance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.