Medicare tax is also withdrawn from your paychecks. In 2020 about 65 million Americans will receive over one trillion dollars in Social Security benefits.

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

The maximum possible Social Security benefit for someone who retires at.

How much does social security take out. If you start claiming benefits at 66 and your full monthly benefit is 2000 youll get 2000 per month. Dependents 31 million 24 billion. Snapshot of a Month.

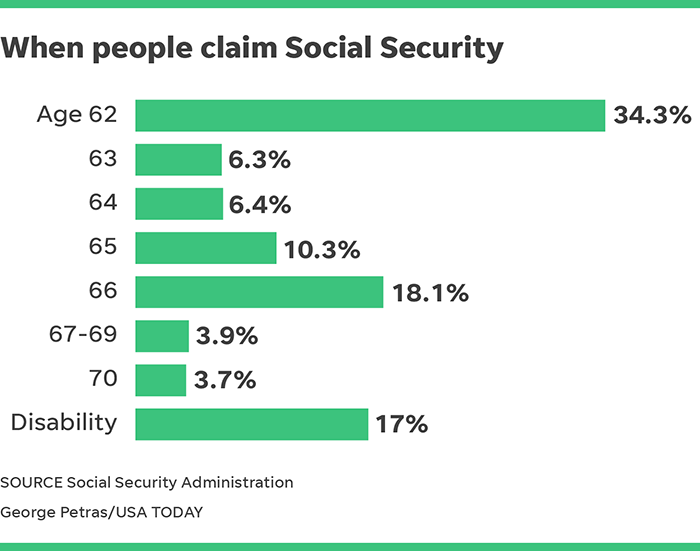

If you wait from 62 to 67 you miss out on 60 months of income 5 years times 12 months per year. The Social Security Old-Age and Survivors Insurance OASI trust fund which pays benefits to retired workers and their survivors will run short of money in 2031 according to a new forecast from the Congressional Budget Office CBO. If you earn more than 17040 in 2018 Social Security will withhold the necessary amount as soon as they find out about it.

Paying for Medicare when you have Social Security. The standard Medicare Part B premium for medical insurance in 2021 is 14850. You can have 7 10 12 or 22 percent of your monthly benefit withheld for taxes.

Youll typically pay the standard Part B premium which is 14850 in 2021. Normally your employer will show the amount of your deductions for each pay period and your total contributions to date. The Social Security portion of your annual FICA payment equals 1240.

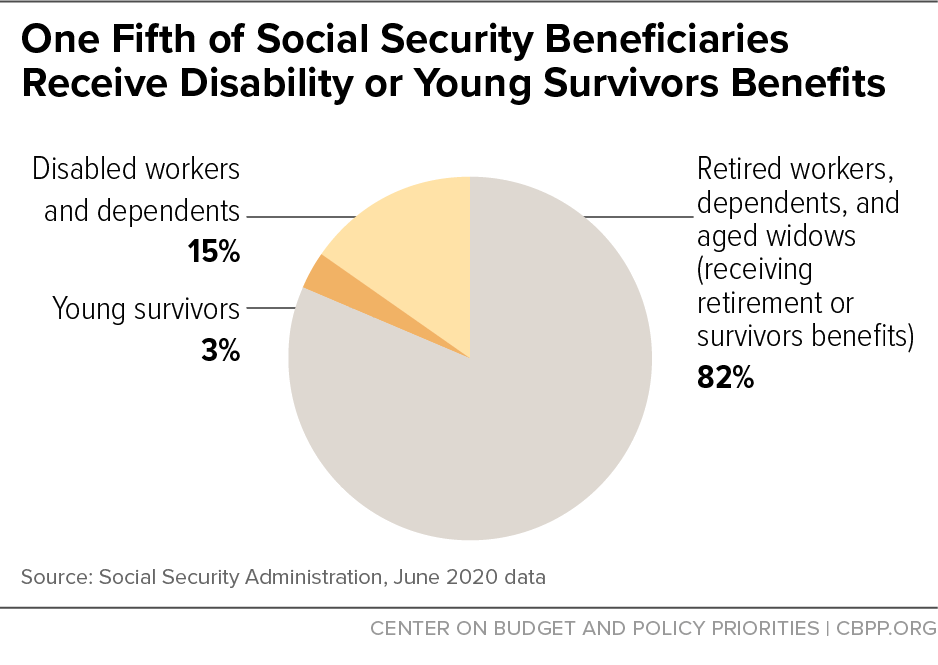

The Medicare portion will total 290. In some cases Social Security can also help support your family if you die. Thats one year earlier than CBOs 2019 projection and three years earlier than the projection issued in April by Social Securitys trustees.

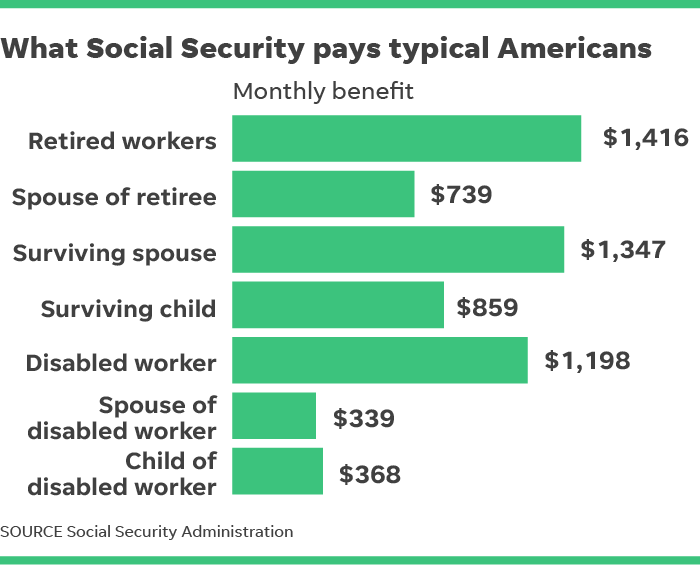

In the year you reach full retirement age we deduct 1 in benefits for every 3 you earn above a different limit but we only count earnings before the month you reach your full retirement age. However you also forego years of money from the Social Security Administration by waiting. June 2020 Beneficiary Data ο Retired workers 458 million 694 billion 1514 average monthly benefit.

However you might have a higher or lower premium amount than the standard cost. The federal government takes the premium cost directly out of your Social Security check to pay for Original Medicare. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Every working American pays into the Social Security and Medicare systems through a 765 payroll tax or a 153 tax if self-employed which. Only these percentages can be withheld. If you will reach full retirement age in 2021 the limit on your earnings for the months before full retirement age is 50520.

Technically the government owes the Social Security fund an estimated 29 trillion money that has been used and not repaid to the fund. This is because their Part B premium increased more than the cost-of-living increase for 2021 Social Security benefits. If you file as an individual with a total income thats less than 25000 you wont have to pay taxes on your social security benefits in 2020 according to the Social Security Administration.

How much you pay depends on the type of Medicare plan and your income. How to Calculate Social Security Benefits. The money is legally held in a special type of bond that by law cannot be used for any other purpose other than to put the money back into the fund.

When you complete the form you will need to select the percentage of your monthly benefit amount you want withheld. For the 2019 and 2020 tax years single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits. Flat dollar amounts are not accepted.

Updated October 23 2020. Lets say your full retirement age is 66. Social Security taxes are designed to pay for benefits when you become old or if you become disabled.

Your Social Security benefits are taxable only if your overall income exceeds 25000 for an individual or 32000 for a married couple filing jointly. In the 2018 tax year thats 128700. However if you have Medicare Advantage you can pay the private health insurer directly instead of having the money taken out of your check.

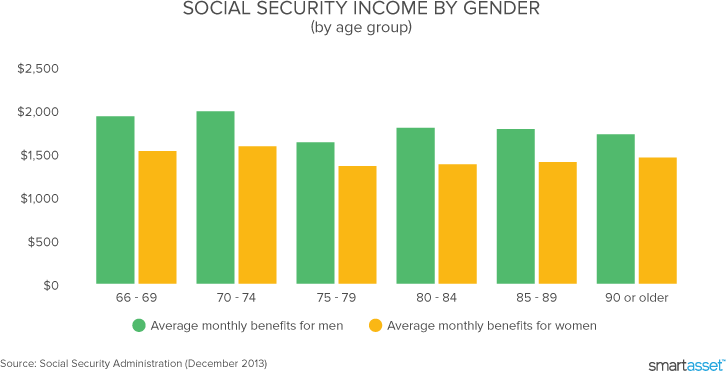

If the income you report is above that threshold you could pay taxes on up to 85 percent of your benefits. The average Social Security benefit was 1543 per month in January 2021. The amount theyd need to withhold is 1 of the benefits payable on your record for each 2 that you earn in excess of 17040 this year.

University Of California Should You Take Social Security At 62

University Of California Should You Take Social Security At 62

Social Security Calculator 2021 Update Estimate Your Benefits Smartasset

Social Security Calculator 2021 Update Estimate Your Benefits Smartasset

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg) How Much Social Security Will You Get

How Much Social Security Will You Get

:max_bytes(150000):strip_icc()/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg) How Much Social Security Will You Get

How Much Social Security Will You Get

A Foolish Take How Much Does Social Security Pay The Motley Fool

A Foolish Take How Much Does Social Security Pay The Motley Fool

Will Social Security Have You Covered Principal

Will Social Security Have You Covered Principal

Social Security Survivor Benefits Can Give Your Loved Ones A Big Check Feb 2 2000

Social Security Survivor Benefits Can Give Your Loved Ones A Big Check Feb 2 2000

/social-security-survivor-benefits-for-a-spouse-2388918-v3-5bc644f846e0fb0026f5c3e2.png) Social Security Survivor Benefits For A Spouse

Social Security Survivor Benefits For A Spouse

How Much Does Social Security Pay On Average To Retired Workers

How Much Does Social Security Pay On Average To Retired Workers

Social Security United States Wikipedia

Social Security United States Wikipedia

A Foolish Take How Much Does Social Security Pay The Motley Fool

A Foolish Take How Much Does Social Security Pay The Motley Fool

What S The Most Popular Age To Take Social Security

What S The Most Popular Age To Take Social Security

When Should You Take Social Security Charles Schwab

When Should You Take Social Security Charles Schwab

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.