What is the United States national gas tax rate. Gas stations generally only profit a few cents per gallon.

Highest Gas Tax And Prices In The U S By State 2020 Statista

Highest Gas Tax And Prices In The U S By State 2020 Statista

First off the federal gas tax comes out to 184 cents on the gallon sold in every state.

How much is gas tax. California pumps out the highest tax rate of 612 cents per gallon followed by Pennsylvania 587 cpg Illinois 5498 cpg and Washington 494 cpg. Currently state gas taxes range from 1432 cents per gallon in Alaska to 6205 cents per gallon in California not including the 184 cents per gallon federal gas tax. How Much is the Gas Guzzler Tax.

The tax rate is based on combined highway and city mileage per gallon. Back to Michigan Sales Tax Handbook Top. On average as of April 2019 state and local taxes and fees add 3424 cents to gasoline and 3589 cents to diesel for a total US volume-weighted.

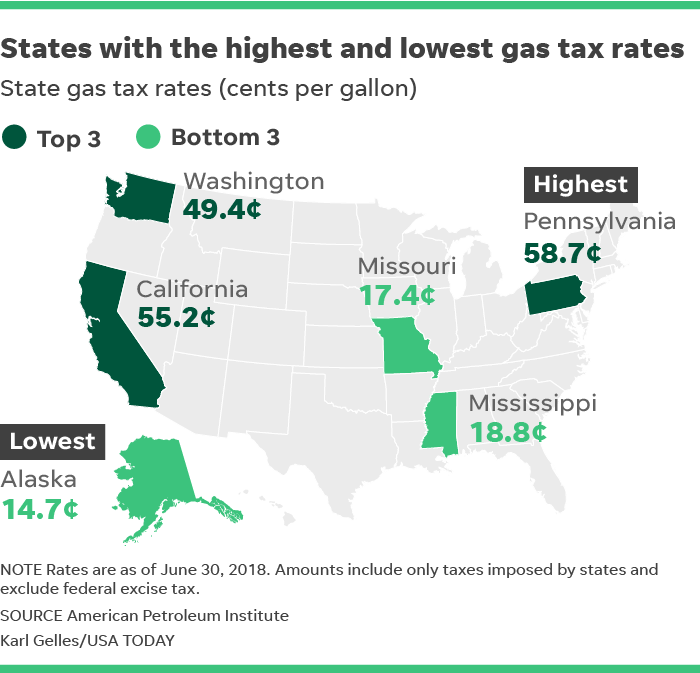

The average State tax is in the neighborhood of 30 cents on a gallon and the Federal tax is 18 cents a gallon. Youll find the lowest gas tax in Alaska at 1377 cents per gallon followed by Missouri 1742 cpg and Mississippi 1879 cpg. These tax rates are based on energy content relative to gasoline.

Heres whats on the tax side of the ledger. State and local gasoline taxes covered 191 percent of total road spending while the aid provided from the federal government out of the 184 cents per gallon federal gas tax covered an additional 117 percent for a total of 308 percent covered by gas taxes. What percentage of the cost of gas in Pennsylvania comes from taxes and gas station profit.

This tax pays for infrastructure projects and mass transportation costs and it includes a 01 cent per gallon fee that goes to the Leaking Underground Storage Tank trust fund. Rather than dedicating all gas tax revenue to roads and highways many states divert portions of the revenue to non-road and non-transportation purposes. Youll find the lowest gas tax in Alaska at 1466 cents per gallon followed by Missouri 1742 cpg and Mississippi 184 cpg.

California pumps out the highest tax rate of 6247 cents per gallon followed by Pennsylvania 587 cpg Illinois 5201 cpg and Washington 494 cpg. The amount was last adjusted 25 years ago in 1993 back when a gallon cost about 106. Does it not occur to anyone that the oil industry is the only industry which is required to post the full cost of a gallon of gas without revealing how much of that cost is really just Ste and Federal gasoline taxes.

The United States federal excise tax on gasoline is 184 cents per gallon and 244 cents per gallon for diesel fuel. The rate can range from 1000 for vehicles that get at least 215 mpg but less than 225 mpg all the way up to 7700 for vehicles that get less than 125 mpg. In the United States the.

Included in the Gasoline DieselKerosene and Compressed Natural Gas rates is a 01 per gallon charge for the Leaking Underground Storage Tank Trust Fund LUST. And then two cents every other year for the next 10 years which would result in 22 cents by the year. 51 rows Gas tax is different for gasoline diesel aviation fuel and jet fuel.

In most areas state and federal excise taxes amount to about 13 of the cost of a gallon of gas. The United States federal excise tax on gasoline is 184 cents per gallon cpg and 244 cents per gallon cpg for diesel fuel. It would apply to our current gas tax it would be 10 cents the first year McFarland said.

Its currently an 183 cent-per-gallon tax on gasoline and 243 cents on diesel plus a 01-cent tax on both to help fund expenses associated with fuel regulation In 1996 and part of 1997. According to the American Petroleum Institute the average price for a gallon of gasoline as of August of. Take the case of California.

Many Americans might be surprised by the answer because the price to actually produce and deliver the product is much lower than the amount posted at the pump. Californias excise taxes on gasoline come to 505 cents per gallon. How much does a gallon of gasoline cost.

The federal tax was last raised October 1 1993 and is not indexed to inflation which increased by a total of 77 percent from 1993 until 2020. The federal gasoline excise tax is 184 cents per gallon as of 2020. The federal government charges an excise tax of 184 cents per gallon.

And since the federal gas tax is not pegged to inflation gas could cost 1000 a gallon and the feds would still only collect 184 cents. Gas and Other Transportation Taxes. 52 rows The current federal motor fuel tax rates are.

Gas Tax Rates July 2018 State Gas Tax Rankings Tax Foundation

Gas Tax Rates July 2018 State Gas Tax Rankings Tax Foundation

See How Much Ohio S Gas Tax Increase Will Cost You Cleveland Com

See How Much Ohio S Gas Tax Increase Will Cost You Cleveland Com

This Map Shows How Gas Taxes Determine The Price At The Pump

This Map Shows How Gas Taxes Determine The Price At The Pump

Pump Prices And California Corruption A Special Report Post Scripts

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

California Where Do Your Gas Taxes And Car Fees Actually Go

California Where Do Your Gas Taxes And Car Fees Actually Go

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Gasoline Price Calculations Excise Taxes State Fees And More Add Up At Pump Don T Mess With Taxes

Rising Gas Taxes Which States Have Highest And Lowest Rates

Rising Gas Taxes Which States Have Highest And Lowest Rates

Why Are Gas Taxes So High John Locke Foundation John Locke Foundation

California Gas Tax What You Actually Pay On Each Gallon Of Gas

California Gas Tax What You Actually Pay On Each Gallon Of Gas

California S Gas Tax Is Going Up Nov 1 Even If You Don T Notice Right Away Daily News

California S Gas Tax Is Going Up Nov 1 Even If You Don T Notice Right Away Daily News

File Gas Tax Jpeg Jpg Wikimedia Commons

File Gas Tax Jpeg Jpg Wikimedia Commons

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.