Groceries prescription drugs and non-prescription drugs are exempt from the New York sales tax. Sales Tax Web File the e-file mandate requires most taxpayers to Web File PrompTax.

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

Proposed bills would impose sales tax on digital advertising May 05 2020.

New york sales tax 2020. These calendars include the due dates for. New York has a 4 statewide sales tax rate but also has 988 local tax jurisdictions including cities towns counties and special districts that collect an average. Depending on the volume of sales taxes you collect and the status of your sales tax account with New York you may be required to file sales tax returns on a monthly semi-monthly quarterly semi-annual or annual basis.

The County sales tax rate is 4. The New York state sales tax rate is 4 and the average NY sales tax after local surtaxes is 848. Parking garaging or storing motor vehicles.

6Understanding Local Government Sales Tax in New York State 2020 Update Local Sales Tax Revenue New York State local governments received 169 billion in sales tax revenue in their fiscal years ending FYE 2019 accounting for 97 percent of all local government revenues17. Metropolitan commuter transportation mobility tax MCTMT 2021 2020 For information about other tax filing due dates see. On this page we have compiled a calendar of all sales tax due dates for New York.

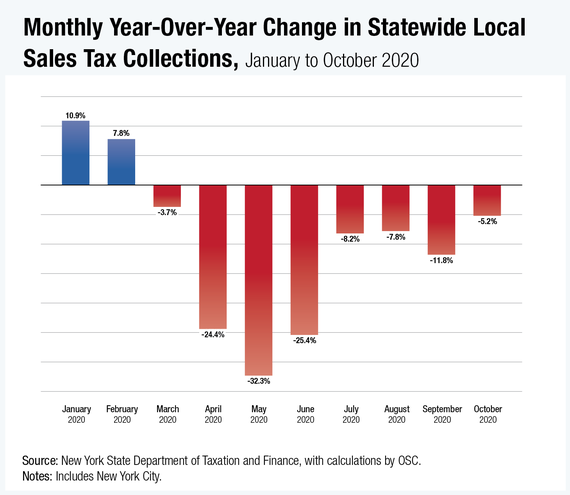

The New York sales tax rate is 0. While the Big Apple saw an 187 percent dip no other regions shortfall exceeded 3 percent. Tax filing calendar.

Alcoholic beverages tax Individuals. Calendar of New York Sales Tax Filing Dates. Sales tax forms and instructions current tax year March 1 2020 through February 28 2021 Sales tax forms and instructions prior years and periods February 29 2020 and prior Sales tax credits and refunds.

888 is the highest possible tax rate New York City New York The average combined rate of every zip code in New York is 7959. The current total local sales tax rate in New York City NY is 8875The December 2020 total local sales tax rate was also 8875. The combined sales and use tax rate equals the state rate currently 4 plus any local tax rate imposed by a city county or school district.

Sales tax penalties and interest. Counties and cities can charge an additional local sales tax of up to 4875 for a maximum possible combined sales tax of 8875. The New York sales tax rate is currently 4.

To be sure you arent charged a fee access the Free File software thats right for you directly. 48 rows By sales tax definition this sum is calculated as an additional percentage added. New York City NY Sales Tax Rate.

An additional sales tax rate of 0375 applies to taxable sales made within the Metropolitan Commuter Transportation District MCTD. Municipal governments in New York are also allowed to collect a local-option sales tax that ranges from 3 to 4875 across the state with an average local tax of 4229 for a total of 8229 when combined with the state sales tax. If your 2020 income was 72000 or less youre eligible to use Free File income tax software.

If products are purchased an 8875 combined City and State tax will be charged. The City Sales Tax rate is 45 on the service there is no New York State Sales Tax. New York Citys collections created nearly the entire shortfall as its sales tax revenue went from 82 billion in 2019 to 67 billion last year.

4375 7 75 8 8125 825 8375 85 8625 875 8875 are all the other possible sales tax rates of New York cities. Even if your business did not make any taxable sales or purchases during the reporting period you must file your sales and use tax return by the due date. If youre registered for sales tax purposes in New York State you must file sales and use tax returns quarterly part-quarterly monthly or annually with the department.

Prepare and file your income tax return with Free File. The City charges a 10375 tax and an additional 8 surtax on parking garaging or storing motor vehicles in Manhattan. New York has state sales tax of 4 and allows local governments to collect a.

New York has a statewide sales tax rate of 4 which has been in place since 1965. Its our no-cost way to easily complete and file your federal and New York State income tax returns online. For more information see Free File your income tax return.

Charting Ny S Fiscal Collapse Empire Center For Public Policy

Charting Ny S Fiscal Collapse Empire Center For Public Policy

Covid 19 S Toll On The Local Economy A Preliminary Estimate Of Job Losses Tax Revenue Declines

Covid 19 S Toll On The Local Economy A Preliminary Estimate Of Job Losses Tax Revenue Declines

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

New York S Sales Tax Down 10 But North Country Holds Steady Ncpr News

New York S Sales Tax Down 10 But North Country Holds Steady Ncpr News

2020 State Individual Income Tax Rates And Brackets Tax Foundation

2020 State Individual Income Tax Rates And Brackets Tax Foundation

Dinapoli Local Sales Tax Collections Drop 8 2 Percent In July Office Of The New York State Comptroller

Dinapoli Local Sales Tax Collections Drop 8 2 Percent In July Office Of The New York State Comptroller

Dinapoli Local Sales Tax Collections Drop Over 32 Percent In May Office Of The New York State Comptroller

Dinapoli Local Sales Tax Collections Drop Over 32 Percent In May Office Of The New York State Comptroller

Area Sales Taxes Erratic As State Posts Losses News Oleantimesherald Com

Area Sales Taxes Erratic As State Posts Losses News Oleantimesherald Com

Dinapoli April Sales Tax Collections Decline More Than 24 After Covid 19 Shutdown Real Estate In Depth

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

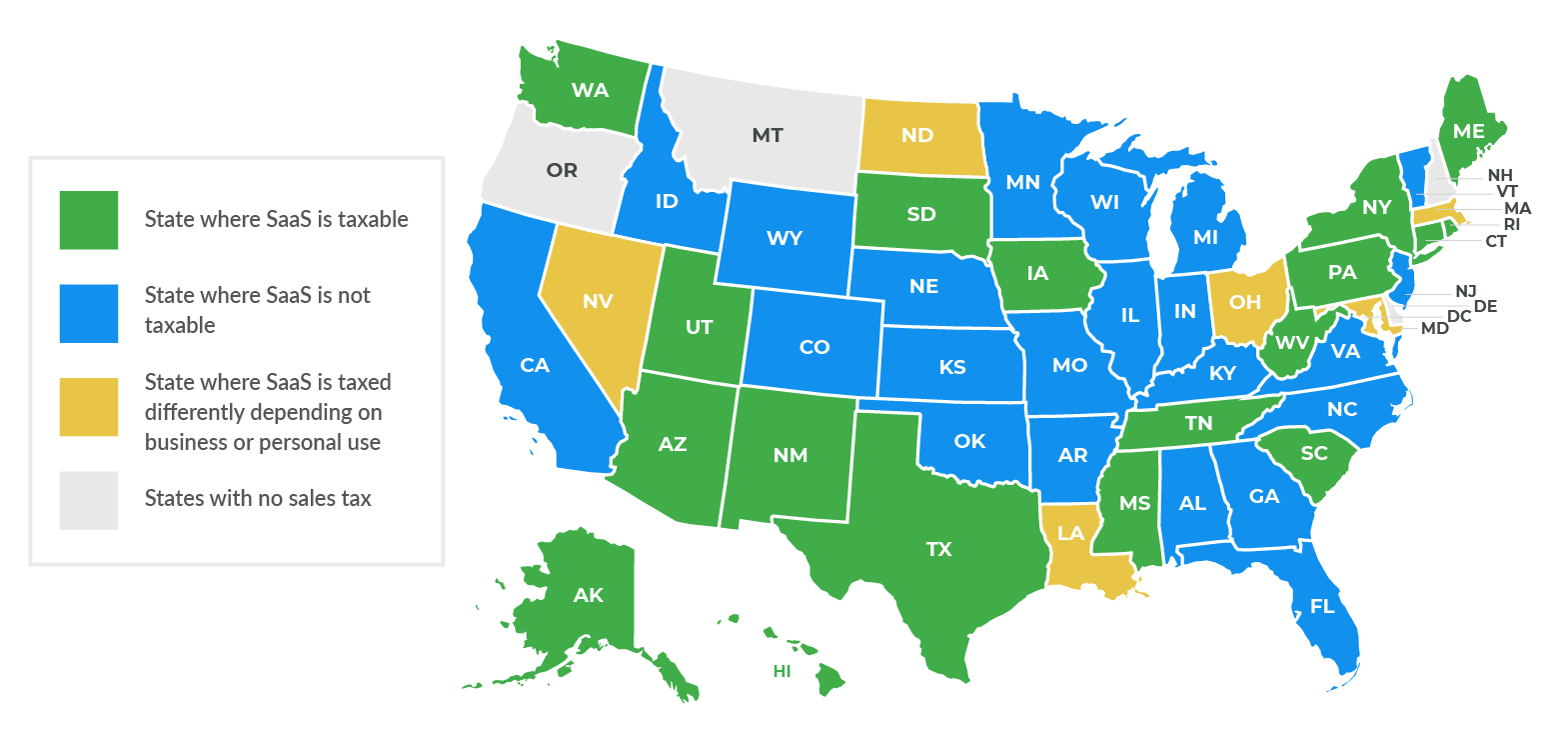

Sales Tax By State Is Saas Taxable Taxjar Blog

Sales Tax By State Is Saas Taxable Taxjar Blog

Dinapoli January Local Sales Tax Collections Down 5 9 Percent Office Of The New York State Comptroller

Dinapoli January Local Sales Tax Collections Down 5 9 Percent Office Of The New York State Comptroller

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.