Generally the higher your credit score the more damage a negative account can do. To use an example if you have 10000 in credit card debt and 25000 in total credit limits across all your credit cards your credit utilization ratio is 40 because 10000 divided by 25000.

How Paying Off Student Loan Debt Affects Your Credit Score

How Paying Off Student Loan Debt Affects Your Credit Score

Ad Helping Businesses Families In Houston With Bankruptcy Since 1986.

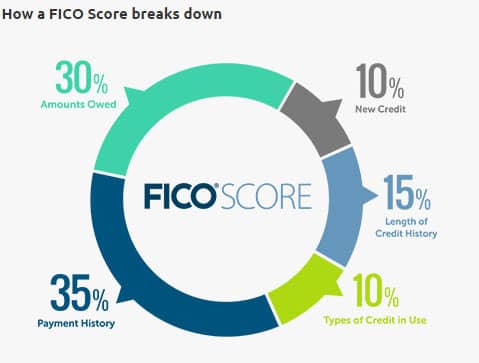

Does paying off credit cards help credit score. Accounting for 35 percent of your score payment history leads all five scoring categories with amounts owed coming in second at 30 percent followed by length of credit history at 15 percent and credit mix and new credit accounting for 10 percent each. As is often the case youll get the best scores by using credit as long as you use it wisely. Ad Helping Businesses Families In Houston With Bankruptcy Since 1986.

Paying off your credit card balances is beneficial to credit scores because it lowers your credit utilization ratio. Over time your credit score can improve after a charge-off if you continue paying all your other accounts on time and handle your debt responsibly. One of the most effective ways to improve your credit scores is by paying off your credit card debtCredit card utilization is a big credit score ranking factor.

Paying bills on time is the biggest factor making up your FICO score. Below CNBC Select takes a look at how paying off credit card debt can improve your credit score. Bev OShea August 11 2017 Many or all of the products featured here are from our.

Paying Off a Credit Card Account If the account in question is a credit card paying that balance can improve your credit scores quickly. Lower credit utilization is better for your credit scores. The two biggest factors that make up about two-thirds of your score are paying on time and the amount you owe.

Paying a charge-off also will not improve your credit score at least not immediately. It stands to reason that completely paying off a maxed out credit card can raise your score by the same amount. Its always a good idea to pay off credit card debt regardless of how that debt repayment impacts your credit scores.

But keeping accounts open and active can help your scores. Paying off credit cards can improve credit scores substantially as outstanding debt is the second most heavily-weighted factor in calculating scores. Should your credit report show any past late payments a new card with a positive though short history can help your score by raising your proportion of good paying on-time to bad late-paying accounts.

Every maxed-out credit card you have can drop your credit score by anywhere from 10 to 45 points depending on where your score started. Unless you have an intro APR. Paying off a credit card can increase your credit score but that isnt always the caseImage source.

Paying off a credit card will help your score especially if you were using more than 30 of your available limit. That credit utilization is one of the easiest and quickest ways to boost your score. Paying off debt also lowers your credit utilization rate which helps boost your credit score.

The reason why paying off your credit card debt is positive for your credit score is because not only because credit bureaus look at an individuals credit card debt but also because their credit utilization ratio will improve when credit card is paid off as measured against availability of credit 1. We examine factors that determine credit scores and evaluate two case studies where loan seekers paid off credit debt to improve scores. Paying your credit cards in full can help you save money in interest and should not hurt your credit scores.

Utilization which is the amount of available credit youre using is the second most important factor in credit scores right behind your payment history. In fact both of the most common credit scoring models FICO and VantageScore has credit card utilization as a primary factor in determining your credit scores. Just keep in mind that its usually best to keep revolving accounts open even after youve paid them off.

Paying off your store card next month and as advised leaving it open.